The best way for your business to survive a recession is to be prepared ahead of time. Unfortunately, few companies ever prepare for a recession while things are going well. This is a mistake. Instead, most companies make changes after a recession has hit them. This delay limits their choices. This limitation forces companies to […]

Blog

Smart Strategies for Business Cash Reserves

A cash reserve is a set of funds that a company puts aside to handle financial challenges. It is one of the most important financial resources that a company can develop. A reserve provides financial stability and allows you to operate the business more effectively. Unfortunately, many business owners ignore the importance of having a […]

Factoring for Owner-Operators

Most truckers become owner-operators because they want more money and the freedom to run their own business. But, above all, they want the opportunity to grow and make a successful trucking company. Unfortunately, most owner-operators experience problems because they don’t have enough money to run the business. They are caught off guard when they don’t […]

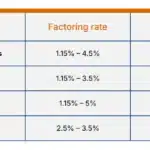

Typical Factoring Rates

In this article, we discuss factoring rates and how to use rates to determine the total cost of using this solution. From this article, you will learn: If you are not familiar with factoring, consider reading “How does factoring work?” before reading this article. If you just want an instant rate quote, try this form. […]

12 Cash Flow Problems and Solutions

Most small businesses encounter a cash flow problem at one time or another. Fortunately, most cash flow problems can be prevented with a bit of preparation and the right strategy. This article lists the 12 most common causes of cash flow problems, along with ways to solve them. 1. Not having a cash reserve Most […]

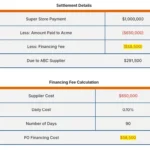

Navigating Purchase Order Financing: Small Business Guide

Purchase order (PO) financing has become a popular option for growing resellers and distributors. It helps cover supplier expenses associated with large purchase orders. However, PO financing can be challenging to understand at first. It follows a different structure and has different requirements than typical financial products. This article helps small business owners navigate the […]

The Smart Way to Expand Your Trucking Fleet

Summary: Many owner-operators enter the trucking business hoping to expand their carrier into a large trucking fleet. But few owner-operators grow their companies using a methodical approach. Instead, they jump at the chance of growth without understanding how to grow the business. This approach seldom works and often ends up in financial failure. We recently […]

What Are Net-30 Terms? How Do They Work?

Summary: Most commercial transactions use payment terms, typically referred to as offering “Net 30 – 60 days.” These terms are a form of credit that typically gives clients 30 to 60 days to pay an invoice. Companies must offer payment terms if they want to remain competitive, especially when bidding for large opportunities. However, offering […]

What is Purchase Order Financing? How Does it Work?

Summary: Purchase order (PO) financing helps small businesses that have a large order and need funds to pay their vendors. It helps cover your supplier expense, enabling you to fulfill the order and book the revenue. While this solution is flexible, it works only with specific transactions. This article explains how PO financing works, who […]

What is Special Assets? What Should You Expect?

Summary: The Special Assets department handles loans that are out of compliance and in trouble. Lenders assign loans to this department to mitigate potential losses. This change marks a turning point in your relationship with the lender, as they likely want to exit the lending relationship. A company can improve its chances of success in […]