Summary: Asset-based loans are an attractive option for middle-market companies due to their flexibility and relatively low cost. However, they are suitable only for companies with good financial management due to their strong covenants and operational requirements. This article examines stand-alone asset-based financing solutions that can be used as an alternative to asset-based loans. These […]

Asset Based Lending

What is Special Assets? What Should You Expect?

Summary: The Special Assets department handles loans that are out of compliance and in trouble. Lenders assign loans to this department to mitigate potential losses. This change marks a turning point in your relationship with the lender, as they likely want to exit the lending relationship. A company can improve its chances of success in […]

Asset-Based Lending Basics

Summary: Asset-based lending is a type of financing that allows a company to leverage its assets. It provides revolving lines of credit and term loans depending on the assets used as collateral. Asset-based lending is common among smaller middle-market companies that need a solution with flexible covenants. This article provides an overview of asset-based financing […]

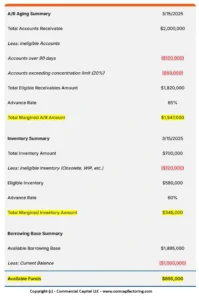

How Does a Borrowing Base Certificate Work?

A borrowing base certificate is a document that a company uses to draw funds from its asset-based loan (ABL). The certificate is typically used in ABLs secured by accounts receivable since these loans are structured as revolving lines. This article explains how borrowing certificates work and covers the following: 1. What is a borrowing certificate? […]

Asset-Based Loan Qualification Requirements

Summary: Asset-based loans are commonly used by small and middle-market companies that need financing. Their main advantage is that they offer a flexible structure and support several types of collateral. Asset-based loans are popular with companies because these loans have fewer covenants and simpler qualification requirements than bank financing. Read “What is an Asset-Based Loan? […]

Eight Advantages of Asset-Based Loans (ABLs)

Asset-based loans (ABLs) are used by small and middle-market businesses to improve liquidity and finance new projects. They offer similar advantages to conventional solutions. However, they are more flexible and have simpler qualification requirements. This article discusses the eight important benefits of asset-based loans. To learn more about asset-based loans, read “What is Asset-Based Lending?“ […]

How to Select the Best Asset Based Lending Company

Selecting the right asset based financing company is one of the most important decisions you can make for your business. Your evaluation process must be designed to ensure you choose the best asset based lender to fit your tactical and strategic financing needs. This article describes a short process to help you evaluate potential lenders. If you are not […]

Financing Options for Distressed Lower Middle-Market Companies (“Special Assets”)

Summary: Middle-market companies that are out of compliance with their lenders are typically assigned to the Special Assets group. Usually, these companies must find a new lender as part of their workout process. Few lenders finance distressed companies in this market segment. Consequently, finding a replacement lender can be a significant challenge for lower middle-market […]

Cash Flow Financing for Small Middle-Market Companies

Summary: Small middle-market companies have fewer financial options than their larger counterparts. Large companies have choices comparable to those of small companies. However, they benefit from better pricing. This article discusses cash flow financing options available to lower middle-market companies. It also includes options that are available to distressed companies. We cover the following: 1. […]

Navigating Asset-Based Loans: Small Business Guide

Asset-based loans (ABLs) enable companies to get financing by leveraging their accounts receivable, inventory, and other assets. These loans are a popular option for Canadian companies due to their flexibility, simpler qualification requirements, and easier compliance. This guide helps business owners understand how ABLs work, which assets can be financed, what lenders look for, and […]