The best way for your business to survive a recession is to be prepared ahead of time. Unfortunately, few companies ever prepare for a recession while things are going well. This is a mistake. Instead, most companies make changes after a recession has hit them. This delay limits their choices. This limitation forces companies to […]

Frequently Asked Questions

Smart Strategies for Business Cash Reserves

A cash reserve is a set of funds that a company puts aside to handle financial challenges. It is one of the most important financial resources that a company can develop. A reserve provides financial stability and allows you to operate the business more effectively. Unfortunately, many business owners ignore the importance of having a […]

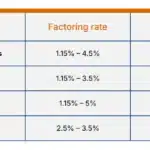

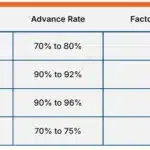

Typical Factoring Rates

In this article, we discuss factoring rates and how to use rates to determine the total cost of using this solution. From this article, you will learn: If you are not familiar with factoring, consider reading “How does factoring work?” before reading this article. If you just want an instant rate quote, try this form. […]

12 Cash Flow Problems and Solutions

Most small businesses encounter a cash flow problem at one time or another. Fortunately, most cash flow problems can be prevented with a bit of preparation and the right strategy. This article lists the 12 most common causes of cash flow problems, along with ways to solve them. 1. Not having a cash reserve Most […]

What Are Net-30 Terms? How Do They Work?

Summary: Most commercial transactions use payment terms, typically referred to as offering “Net 30 – 60 days.” These terms are a form of credit that typically gives clients 30 to 60 days to pay an invoice. Companies must offer payment terms if they want to remain competitive, especially when bidding for large opportunities. However, offering […]

Advantages and Disadvantages of Non Recourse Factoring

Non-recourse invoice factoring plans have quickly become very popular with Canadian companies that are looking for a factoring plan. The main advantage of non-recourse plans is that the factoring company absorbs the loss of advance, if your customer does not pay due to a credit reason. Factoring companies use different rules to define what is a qualifying ‘credit […]

What is Non-Recourse Factoring?

Non-recourse factoring is a type factoring financing in which the factoring company assumes the loss if invoices are not paid due to end customer insolvency. It is one of the two common types of invoice factoring offered by Canadian factoring companies. However, it is also widely misunderstood by clients. In this article, we discuss: 1. […]

How Much Does Factoring Cost?

This article explains how to calculate the factoring fees of a factoring proposal. It covers the three most common proposal fee types: flat-rate, variable-rate, and discount-plus-margin. We cover the following: 1. How does factoring work? This article assumes that you are already familiar with factoring and know how it works. Here is a short summary […]

How Do Factoring Companies Buy Accounts Receivable?

One of the advantages of invoice factoring is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the factoring company in exchange for an immediate payment. This article describes how a company sells their invoices to a factor and covers the following subjects: 1. Factoring basics Invoice factoring […]

Is Invoice Factoring Right for Your Business?

Invoice factoring is a business financing solution popular with small and midsize companies. This article helps you determine if factoring is the right solution for your business. We guide you through eight questions to ask before considering a factoring facility. 1. Can my cash flow problem be fixed using factoring? The first question to ask […]