Companies sell their receivables to improve their cash flow. Having good cash flow is essential if you want to run a successful business. You can have a great product/service and excellent profit margins, but your business will suffer if your cash flow is bad. As a matter of fact, profitable companies can also have serious […]

Frequently Asked Questions

Do You Qualify For Invoice Factoring?

Factoring plans can provide many of the benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing. Most factoring companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice factoring. Note: To learn more about factoring, read […]

Why Must My Customer Send My Payments to the Factoring Company?

One of the chief objections that clients have with using factoring is that their customers need to remit payments to a new address. Actually, notifying the customer of the new payment address and procedure is a standard practice in the industry. Factors use a document commonly known as a notice of assignment. But why is […]

How is a Subordination Used in Invoice Factoring?

Summary: In most cases, setting up a factoring account is relatively simple. Once the factoring contracts are signed, the factor files a lien to secure its position against the accounts receivable, sends notices of assignment, and starts funding the account. Usually, this process is done fairly quickly. Having an existing lien claiming your accounts receivable as collateral delays […]

Why Do Companies Use Factoring?

Factoring is a product that helps companies that have slow-paying clients. These companies usually can’t wait 30 to 60 days to get paid by clients. Factoring solves this problem by financing their invoices. It provides businesses with cash that they can use to run the business. Companies often use the funds from factoring to: 1. […]

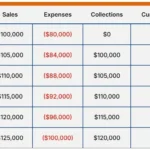

Cash Flow Problems Due to Growth

Sales growth has to be managed correctly, or it can actually bring serious problems to a company. Few entrepreneurs ever consider this outcome because they believe all growth is good. But growing sales too quickly, or getting several very large orders, can create serious cash flow problems. These problems can sometimes be severe enough to […]

Why Are Net-90 Invoices Not Factorable?

Some companies ask their vendors to provide net-90 days or longer to pay invoices. This request often strains the vendor’s cash flow. Few companies can wait three months to get paid. Vendors often address this challenge by trying to finance these invoices. Unfortunately, most net-90 invoices cannot be financed with factoring. This article explains why […]

How Quickly Can Invoice Factoring Companies Provide Financing?

One advantage of factoring over other options is that many finance companies can get you funding quickly, usually within days. However, several things can delay the transaction. This article explains the factor’s onboarding process, potential transaction challenges, and how to streamline your funding process. We cover: 1. Overview of the process The onboarding process to […]

How to Get Credit from Suppliers

Most established companies get credit terms from their suppliers. This credit enables companies to buy goods or services while paying the supplier on net-30 to net-60 terms. Clients usually demand payment terms from their suppliers because it improves their cash flow. They get to use the supplier’s services or products for a few weeks before […]

What is a Notice of Assignment? (Invoice Factoring)

A Notice of Assignment (NOA) is a document that factoring companies send to the end-customers of their clients. This document informs end-customers of the factoring financing relationship. Clients usually have some concerns when they learn that a factor will notify their customers. This article addresses these concerns and explains how the NOA works, why it […]