Purchase order (PO) financing has become a popular option for growing resellers and distributors. It helps cover supplier expenses associated with large purchase orders. However, PO financing can be challenging to understand at first. It follows a different structure and has different requirements than typical financial products. This article helps small business owners navigate the […]

Purchase Order Financing

What is Purchase Order Financing? How Does it Work?

Summary: Purchase order (PO) financing helps small businesses that have a large order and need funds to pay their vendors. It helps cover your supplier expense, enabling you to fulfill the order and book the revenue. While this solution is flexible, it works only with specific transactions. This article explains how PO financing works, who […]

Financing Sales to Big Box Retailers

Becoming a distributor for a large big box retailer – companies such as Walmart, Loblaws, or Rona- can be both a important opportunity and a major challenge at the same time. Most big retailers can place large purchase contracts, which are great for revenues. However, they also negotiate payment terms that enable them to pay your invoices […]

Financing your Imports from China and Asia

Resellers and distributors often have to play a very delicate game of balancing their cash flow. This can even be more challenging if you are buying goods from factories in China, or anywhere in Asia for that matter. On one hand, the Chinese factories will want you to pay for the goods in a secure […]

Financing for Resellers and Distributors

For many resellers, distributors and importers, managing cash flow is a very important but delicate task. Unless you have a long established relationship with your supplier, they will likely ask you to prepay for goods – or pay upon shipment. On the other hand, your commercial clients will often demand to pay your invoices in […]

Advantages and Disadvantages of Purchase Order Financing

In recent years, purchase order (PO) financing has been gaining popularity as a tool to finance companies that have been awarded a large purchase order. In this article, we discuss: 1. What is purchase order financing? Purchase order financing helps distributors and resellers that need funds to fulfill large purchase orders. The solution helps pay […]

Using PO Financing to Fulfill Large Orders

Getting a large order from a coveted client can provide an important opportunity to grow a small business. If you manage the order correctly, your client is very likely to become a repeat customer. And a large order is almost always a stepping stone to even larger orders. However, if you get a large order […]

How to Choose the Best PO Financing Company

The market is full of companies that advertise purchase order (PO) financing programs. However, only a few companies have the experience, knowledge, and capital to handle these transactions successfully. Choosing the right finance company is important because it plays a critical role in the outcome of your transaction. In this article, we discuss: 1. What […]

Who Can Use Purchase Order Financing?

Purchase order (PO) financing is a flexible product that can help small companies handle large sales. However, PO funding has some limitations and is not for every company. This article helps you understand PO financing and determine if your company is a good candidate for it. The following topics are discussed: 1. What is purchase […]

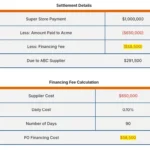

Purchase Order Financing Cost and Rates

Summary: Purchase order financing is commonly used by small companies that have won a large purchase order but don’t have the financial means to fulfill it. This article discusses the average PO financing rates and how transactions are structured. This information will help you determine if PO financing is the right solution for you. The […]