Some companies ask their vendors to provide net-90 days or longer to pay invoices. This request often strains the vendor’s cash flow. Few companies can wait three months to get paid. Vendors often address this challenge by trying to finance these invoices. Unfortunately, most net-90 invoices cannot be financed with factoring. This article explains why […]

Receivables Financing

How to Finance Your Business in Canada (10 Options)

This article covers the ten most effective ways to finance a small or growing company. We cover several options that can be used to finance a wide range of situations. What do you need the funds for? There are several options you can use to finance a business. Some products are flexible and can be […]

How Does Factoring Work?

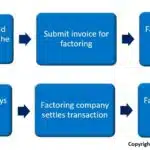

Summary: Factoring is a type of financing that helps improve the cash flow of companies that have slow-paying invoices. This form of financing gives the client access to immediate funds, which can then be used to pay for business expenses and to grow. In this article, we show you how factoring works. We go over […]

What is Factoring?

Summary: Factoring is a form of financing that helps companies with cash flow problems due to slow-paying clients. It allows your business to finance invoices, which improves your company’s working capital. Factoring transactions are structured as the sale of accounts receivables rather than as a business loan. Consequently, they can be set up quickly and […]