It’s impossible to grow a company if you cannot pay suppliers on time. Many manufacturing companies face this problem when they experience a growth phase. The reason is often simple. As your purchase orders from clients grow, so do your orders to your material/product suppliers. However, if growth exceeds the amount of credit that your […]

Blog

Do You Qualify for Supplier Financing?

Supplier financing is a form of trade credit financing available to manufacturing companies and distributors (learn more). Your company must meet the following requirements to qualify for this solution. 1. Be a manufacturer or product supplier Supplier financing is available only to manufacturing companies and distributors. The solution helps finance the costs of purchasing goods […]

What is Supplier Financing?

Supplier financing is a type of supply chain financing that is designed for manufacturers and distributors. It helps them cover supplier expenses, enabling them to fulfill large orders and build inventory. This article covers the following subjects: 1. Supplier financing vs. supply chain financing The terms “supplier financing” and “supply chain financing” are often used […]

How Does Inventory Financing Work?

Inventory financing is a type of asset based lending that allows your company to leverage existing inventory. It can provide your company with funds to purchase additional inventory or handle corporate expenses. From this article, you will learn: How inventory financing works What type of due diligence is required to set up a line Advantages and disadvantages of this […]

Inventory Financing vs. Purchase Order Financing

Both purchase order (PO) financing and inventory financing can be used to finance certain types inventory. However, both solutions work very differently and serve very different business objectives. From this article you will learn: 1. What is purchase order financing? Purchase order financing allows you to finance the supplier costs associated with a specific customer purchase order. […]

Can Asset Based Lending Finance a Small Business?

Asset based lending has been growing in popularity as a way to finance small and mid-sized companies. Asset based loans are easier to get than commercial lines of credit and provide more flexibility. Initially, asset based loans were offered only to mid-sized companies – those with at least 50 million dollars (CAD) in yearly turnover. However, some asset based […]

Best Trucking Forums in Canada

Online trucking forums are one of the best resources for new and growing trucking companies. Most forums have seasoned truckers that participate in daily conversations and are willing to help fellow drivers. If you are interested in becoming a successful owner-operator, consider participating in these forums. These forums can provide advice on how to start, […]

What Is an Asset-Based Loan (ABL)? How Does it Work?

Summary: An asset-based loan (ABL) is a type of business financing secured by a company’s assets. This financing improves liquidity and can be used to cover expenses or to invest in company growth. Asset-based loans can be structured as a term loan, revolving line, or a combination of both. The loan structure depends on the […]

Should You Offer Early Payment Discounts? (2% / 10 Net 30)

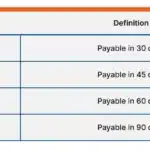

An early payment discount is an incentive that companies receive from suppliers in exchange for a quick payment. It is usually offered by suppliers that need to improve their cash position. In this article, we discuss: 1. Why do you need early payment discounts? Selling to commercial clients can be a challenge for small and […]

How to Get High-Paying Freight Loads

The most important job for any owner-operator or small fleet owner is finding the best-paying freight loads to haul. For many, this task is the most difficult part of owning a trucking company. Unfortunately, many truckers and owner-operators go out of business because they don’t know how to find good loads. This article shows you […]