Every so often, clients want to factor an invoice that has not yet been fulfilled. Basically, the invoice is for work that is about to begin or products that will be delivered soon. These invoices are commonly referred to as pre-delivery invoices. Unfortunately, these invoices cannot be factored. This article explains why factoring companies cannot […]

Blog

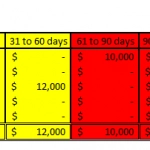

The Importance of the Accounts Receivable Aging Report

The Accounts Receivable (A/R) Aging report is a critical tool for managing your business. This is why most lenders and factoring companies request this report as part of their due diligence process. Unfortunately, it’s one of the most valuable yet underutilized reports. This article helps you understand the value and uses of the A/R Aging […]

Why Can’t You Factor Net-90 Invoices?

Every so often, a client may want to factor an invoice that is due in 90 days or more. These types of invoices become more common during difficult economic times. Unfortunately, some larger companies are permanently moving their payment terms to net-90 and beyond for all suppliers. This time frame may help the larger company’s […]

Why do Staffing Agencies Get Higher Factoring Advances?

Summary: Most factoring companies advertise that they provide an advance of 80% to 90% of the invoice, depending on the client’s industry. For example, a manufacturing company with solid clients will likely get an advance of 80% to 85%. On the other hand, a staffing agency with similar clients will get a 90% advance. This […]

The Invoice Verification Process

Most factoring companies verify your invoices before depositing the advance into your bank account. Factors verify invoices to ensure they are accurate and don’t have any problems. This article explains the processes that factoring companies use to verify invoices. It covers: Why are invoices verified? Verification methods Customer impact What happens if there is a […]

The Due Diligence Process in Factoring

Due diligence is the process of reviewing a client’s information to determine if they are a good candidate for factoring financing. One of the advantages of factoring is that the due diligence process is simpler and faster than the process for other solutions. This article covers: If you need more information, read “What is factoring? […]

How to Finance A Wholesale Company in Canada

Wholesale companies can be very cash-flow-intensive businesses. You often need to buy products from suppliers to build inventory and fulfill sales. Unless you have payment terms with your suppliers, they often ask that you pay for the goods in advance or upon receipt. On the other hand, commercial clients usually demand payment terms as a condition of […]

Finance an Oil & Gas Pipeline Construction and Maintenance Company

Managing the cash flow of an oil and gas pipeline construction and maintenance company is challenging. Managers at the company often face complex operations and demanding cash flows. Consequently, the company risks financial problems if its finances are not managed correctly. This article discusses companies’ most common cash flow problems and provides two possible solutions. […]

Financing Your Import Business with Purchase Order Financing

Managing the cash flow of an import company can be challenging for a small or mid-sized company. While import companies can be profitable and have high gross margins, they require a substantial cash reserve to operate. And you need an even bigger cash reserve if your company is growing or taking larger orders. You need this […]

Will Using Fuel Advances Help My Small Trucking Fleet?

Summary: Fuel advances have been gaining popularity among owner-operators and small fleet owners in recent years. They can be a useful resource for carriers that are just starting out or growing quickly. However, fuel advances also have drawbacks and can be an expensive solution. Carriers should use them carefully. This article explains how fuel advances […]