Getting a large order from a coveted client can provide an important opportunity to grow a small business. If you manage the order correctly, your client is very likely to become a repeat customer. And a large order is almost always a stepping stone to even larger orders. However, if you get a large order […]

Blog

How to Choose the Best PO Financing Company

The market is full of companies that advertise purchase order (PO) financing programs. However, only a few companies have the experience, knowledge, and capital to handle these transactions successfully. Choosing the right finance company is important because it plays a critical role in the outcome of your transaction. In this article, we discuss: 1. What […]

How to Fund Freight Bills Using Factoring

Summary: Most trucking companies encounter cash flow problems at one point or another. This happens because managing a trucking company’s cash flow is challenging. Cash flow problems occur because most expenses are immediate while revenues are delayed by 30 to 60 days. This situation creates a gap in your cash flow that affects your ability […]

Who Can Use Purchase Order Financing?

Purchase order (PO) financing is a flexible product that can help small companies handle large sales. However, PO funding has some limitations and is not for every company. This article helps you understand PO financing and determine if your company is a good candidate for it. The following topics are discussed: 1. What is purchase […]

Seven Benefits of Factoring Fuel Advances

Running a truck or a small fleet is very expensive. The cost of fuel, which must be bought effectively, is one of the biggest expenses for fleet owners. Keeping your units fueled up can be difficult. Many shippers and brokers don’t offer quick pays. Instead, they pay their invoices in 30 to 60 days. Most […]

Asset-Based Lending Basics

Summary: Asset-based lending is a type of financing that allows a company to leverage its assets. It provides revolving lines of credit and term loans depending on the assets used as collateral. Asset-based lending is common among smaller middle-market companies that need a solution with flexible covenants. This article provides an overview of asset-based financing […]

Financing Growth: Freight Factoring for Trucking

Summary: Managing a growing freight carrier is difficult, especially while growing a fleet and adding drivers. While business growth is beneficial, it can also create cash flow problems. This article discusses how fast-growing Canadian carriers can use factoring to improve cash flow. You will be able to determine if it is the right solution to […]

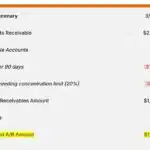

How Does a Borrowing Base Certificate Work?

A borrowing base certificate is a document that a company uses to draw funds from its asset-based loan (ABL). The certificate is typically used in ABLs secured by accounts receivable since these loans are structured as revolving lines. This article explains how borrowing certificates work and covers the following: 1. What is a borrowing certificate? […]

Asset-Based Loan Qualification Requirements

Summary: Asset-based loans are commonly used by small and middle-market companies that need financing. Their main advantage is that they offer a flexible structure and support several types of collateral. Asset-based loans are popular with companies because these loans have fewer covenants and simpler qualification requirements than bank financing. Read “What is an Asset-Based Loan? […]

How to Compare Factoring Company Rates

Most people use a simple approach when comparing proposals from competing factoring companies. They make their decision based on who offers the lowest rate and the lowest application fee. While this strategy is common, it can lead to making a wrong decision. This is because the lowest rate does not always equal the lowest cost, […]