Factoring plans can provide many of the benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing. Most factoring companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice factoring. Note: To learn more about factoring, read […]

Blog

Why Must My Customer Send My Payments to the Factoring Company?

One of the chief objections that clients have with using factoring is that their customers need to remit payments to a new address. Actually, notifying the customer of the new payment address and procedure is a standard practice in the industry. Factors use a document commonly known as a notice of assignment. But why is […]

How is a Subordination Used in Invoice Factoring?

Summary: In most cases, setting up a factoring account is relatively simple. Once the factoring contracts are signed, the factor files a lien to secure its position against the accounts receivable, sends notices of assignment, and starts funding the account. Usually, this process is done fairly quickly. Having an existing lien claiming your accounts receivable as collateral delays […]

How to Run a Successful Staffing Agency

Temporary staffing businesses can be very profitable if managed correctly. However, managing a successful agency is not easy. There is a lot of competition – at least in some markets. You must know how to differentiate your agency, recruit talent, and attract clients – all while dealing with competitors that are vying for the same […]

Why Do Companies Use Factoring?

Factoring is a product that helps companies that have slow-paying clients. These companies usually can’t wait 30 to 60 days to get paid by clients. Factoring solves this problem by financing their invoices. It provides businesses with cash that they can use to run the business. Companies often use the funds from factoring to: 1. […]

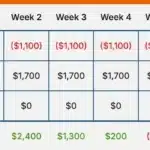

Factoring Cost vs. Rates (They are Different)

Summary: To a large extent, business owners think that factoring rates, factoring fees, and the factoring cost of a dollar are all the same. Although they are related, there are important differences. Actually, low factoring rates may translate to lower fees, but may not necessarily translate to lower costs per advanced dollar. This article helps […]

Guaranteed Sales And Purchase Order Financing

It’s not uncommon for us to speak to a prospect who is very excited about a large purchase order they just received from a very reputable company. Furthermore, as we review the details of the order, we believe that the order will be a good candidate for purchase order financing because it meets these three […]

How to Finance a Roofing Company

Paying employers and suppliers on time is a major concern for small roofing companies. However, making timely payments can be difficult because commercial clients and general contractors (GCs) pay invoices in 30 to 60 days. Offering net payment terms can create cash flow problems for businesses that aren’t well capitalized. This article explains how construction […]

How to Start and Grow a Staffing Agency

When managed correctly, temporary staffing agencies can grow quickly and be very profitable. They represent a great opportunity for the right individual (or group). However, agencies have a lot of moving parts. They need owners/managers who have expertise in many areas. 1. The basics: How does a staffing agency make money? Temporary staffing agencies lease […]

How to Find Clients for a Staffing Agency (11 Ways)

One of the skills needed to run a successful staffing agency is knowing how to find and get profitable clients. The Canadian staffing market is very competitive. Many temporary employment agencies are often chasing the same contracts. To succeed, you must know where to find these opportunities – and how to get them. In this […]