The Accounts Receivable (A/R) Aging report is a critical tool for managing your business. This is why most lenders and factoring companies request this report as part of their due diligence process. Unfortunately, it’s one of the most valuable yet underutilized reports. This article helps you understand the value and uses of the A/R Aging Report. We cover:

- What is an aging report?

- Why is the A/R Aging Report useful?

- How to improve your invoice aging

- How do factoring companies use the aging report?

1. What is an aging report?

Companies with commercial or government clients usually have to sell their products and services on credit terms. These terms typically give your client 30 to 60 days to pay their invoice. Growing companies usually have a large number of invoices at different stages of their payment cycle.

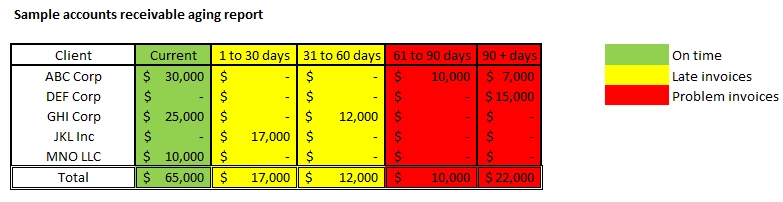

The invoice aging report gives you an overview of your invoices and where they are in the payment cycle. It groups outstanding invoices into date categories based on the number of days they are past due. The categories are usually:

- Current: invoices that are within terms

- 1 to 30: invoices that are 1 to 30 days past due

- 31 to 60: invoices that are 31 to 60 days past due

- 61 to 90: invoices that are 61 to 90 days past due

- 90: invoices that are more than 90 days past due

Here is an example of an aging report:

2. Why is the A/R Aging Report useful?

This report gives you a snapshot in time that helps you determine the approximate quality of your invoices. Managers typically use the report to accomplish the following:

a) Estimate near-term cash flow

The report can be used to estimate your expected near-term cash flow. Keep in mind that this estimate is far from perfect. Your estimate is more accurate if you have an idea of your customer’s payment habits.

b) Identify problem accounts

The report is helpful in your collection efforts and in identifying problem accounts. Customers who are beyond terms pay slowly for a reason. This report allows you to identify the reason for late payment and take corrective action. Common reasons for slow payment include customers who:

- Are habitual slow payers

- Have entered your invoice improperly in their system

- Have cash flow problems

- Have a problem with your product/service

c) Estimate bad debt

This report can be valuable for identifying potential bad debt and write-offs. Generally, a client over 90 days past due is considered a candidate for a write-off. These accounts should be referred to an attorney or collections agency for handling.

3. How to improve your invoice aging

There are several techniques that companies can implement to improve their A/R Aging Reports. This process usually results in improved working capital. The following three strategies work well for most companies:

a) Manage accounts receivable effectively

Every company, regardless of size, needs to have an invoice collection process. The process doesn’t need to be complex or cumbersome. However, the company must have the discipline to follow it regularly. The process should:

- Offer payment terms only to creditworthy customers

- Follow contract payment clauses

- Invoice clients correctly

- Follow up with clients professionally

b) Use commercial credit reports

Using a commercial credit report is the easiest way to determine if a client will pay reliably. The report gives you an idea of how your clients pay other vendors. This information can be used to assess their credit line and if they will pay you on time. Clients who don’t have acceptable credit should pay in advance or upon receipt of the product/service. Two well-known credit report providers are Dun and Bradstreet and Equifax (Canada).

c) Offer discounts for early payment

Companies can also improve their collections and working capital by offering early payment discounts. As the name suggests, clients get a discount if they pay the invoice early. The average discount is 2% for payment in ten days or less, though these terms are negotiable. This tool provides an effective way to improve your cash flow, though it comes at an expense.

4. How do factoring companies use the aging report?

Companies that plan to apply for financing should have up-to-date information in their accounting systems. This information enables you to provide prospective lenders with recent and accurate financial reports.

Most lenders and factoring companies request your latest Accounts Receivable Aging Report as part of their due diligence process. This report is essential since most business financing is secured by accounts receivable, among other assets.

Factoring companies use this report extensively as part of their due diligence process. It helps estimate invoice quality and the expected size of the financing line. To learn more about invoice factoring, read “What is Factoring? How does it work?“

Need a factoring quote?

Are you looking for a factoring quote? We are a leading factoring company and can provide you with high advances at low rates. For information, get an online quote or call us toll-free at (877) 300 3258.