There are two types of factoring financing, commonly known as recourse and non-recourse factoring. Some factoring companies specialize in one type of solution, though many companies offer both. In this article, we explain and compare both types of factoring. The article covers the following:

- How does factoring work?

- What is full recourse factoring?

- What is non-recourse factoring?

- How are payment problems handled?

- Payment and invoice disputes

- Who covers non-payments?

- Advantages / Disadvantages of non recourse factoring

- What type of invoice factoring is better?

- Looking for a factoring company?

1. How does invoice factoring work?

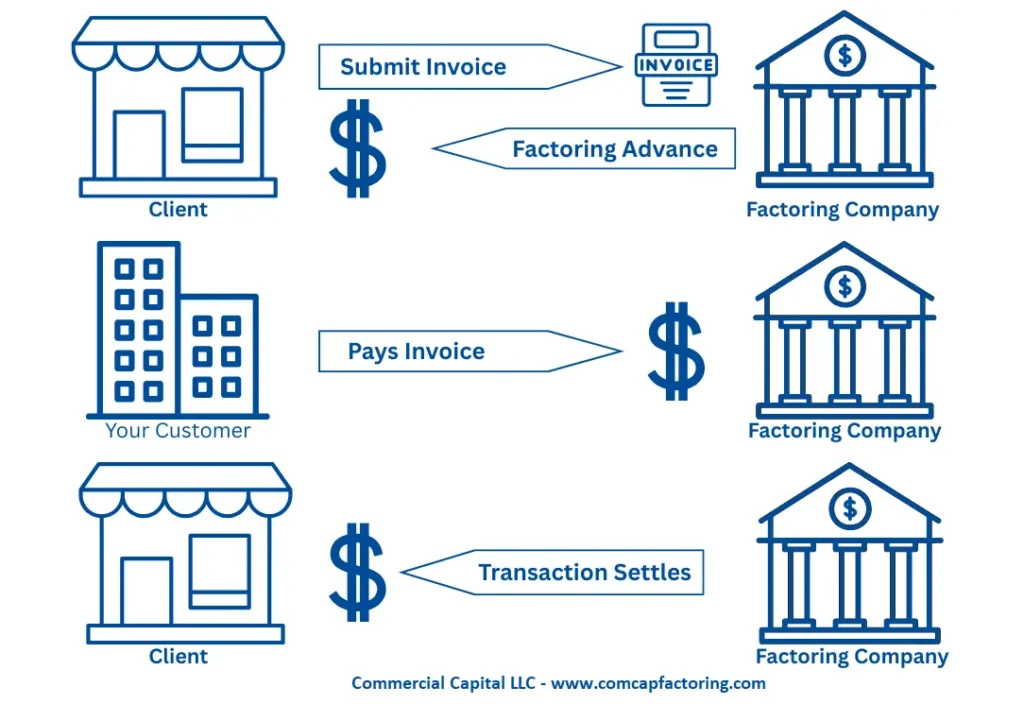

Before discussing the specifics of recourse, it’s important to understand how factoring transactions work. Most transactions are structured as the sale of an asset (an invoice) rather than as a loan. This difference is important because it allows some factoring companies to return “defective” asset purchases.

To finance a transaction, the factoring company buys the financial rights to the accounts receivable from their client. The factoring company pays for these invoices in two installments. This arrangement provides the client with immediate funds. Keep in mind that some transactions in transportation can be done with a single installment.

The factoring transaction ends when the customer pays in full, on their usual schedule. The account is settled at that point and the sale of the invoice concludes. The following image shows the key steps in a factoring transaction.

This leaves an important question open – what happens to the asset (invoice) if the customer does not pay? Or, using a sale analogy, what happens if the factor bought a defective invoice? Can they return it?

Note: if you need more information about factoring, read “What is factoring?” and “How does factoring work?“

2. What is full recourse factoring?

In full recourse factoring, your company remains liable if an invoice is not paid by a customer for any reason. Basically, you agree to repay the factor if they don’t get paid. The amount of the payback varies by factoring company, but it usually involves paying back the advance plus their lost fees.

Factors can be repaid in a number of ways. A common payback method is to replace the disputed invoice with a new invoice of sufficient value. Alternatively, the factoring company can debit the reserves. Lastly, you can simply repay them in cash.

3. What is non-recourse factoring?

For the most part, a non-recourse factoring plan works exactly the same way as a recourse factoring plan. There is one important exception. You do not have to repay the factoring company if an invoice is not paid due to a qualified reason. In most cases, a qualified reason is an insolvency of the customer during the factoring period. This important detail is often misunderstood. Many business owners mistakenly assume that non-recourse factoring eliminates any responsibilities for payment if a customer doesn’t pay. Usually, this is not the case.

For the non-recourse clause to become effective, the reason for the non-payment has to be insolvency. In most cases, it has to be a declared insolvency such as bankruptcy or closure. More importantly, the insolvency must occur during that factoring period usually defined as the first 90 days (this varies) from the time that the factoring company buys the invoice.

As you can see, non-recourse factoring offers a very narrow protection. While it’s good protection, it’s not as comprehensive as many people think.

Many factoring companies offer their own version of non-recourse factoring, which may offer other protections to the client. For example, some factors provide protection if the invoice is not paid due to a closure (without a declared insolvency). Always examine contracts with a competent attorney to make sure that you understand exactly what are you getting.

4. How are payment problems handled?

Every so often, factoring transactions run into problems and invoices are not paid as they should. There are a few reasons why invoices don’t get paid, but the most common include:

- There is a dispute with the work or product

- The customer decides to delay or cancel payment (for whatever reason)

- The customer does not pay due to financial problems

- The customer goes bankrupt

With the exception of disputes (#1), these situations are handled based on the type of factoring that you have and the wording in your contract.

5. Payment and invoice disputes

Factoring agreements, regardless of recourse type, give factors the option to return disputed invoices. Factors return invoices regardless of whether the customer’s dispute is “reasonable” or not. As you can imagine, factoring companies are not in a position to determine the legal correctness in an invoice dispute. That is best resolved by competent legal experts.

Disputes are best handled directly by the client. This allows them to handle the situation appropriately, which helps them keep their reputation intact. Situations that cannot be addressed directly with the customer need to be resolved through other legal means.

6. Who covers slow payments or non-payments?

A common question regarding non-recourse factoring is whether slow payments (past 90 days) and non-payments are covered. The answer depends on the specific details of your factoring agreement.

Some factors absorb the loss if your client closes its doors without declaring bankruptcy. Others will not absorb that type of a loss. However, most factoring agreements do not protect you against slow or non-payments by a customer in good financial health .

7. Advantages and disadvantages of non-recourse factoring

The main advantage of non-recourse factoring is that it can protect you if a customer does not pay for a covered reason. This protection is important since companies can go bankrupt with little advance notice. However, this benefit carries some limitations.

a) Factors may charge a slightly higher price

Factors that offer non-recourse factoring get trade credit insurance to protect themselves from bad invoices. This insurance comes at a cost. As a result, non-recourse factoring lines may have slightly higher rates than comparable recourse lines.

b) Factoring lines may have lower credit limits

The factoring company wants to minimize risk as much as possible. Consequently, the size of a factoring line is determined by the limits imposed by their credit insurance company. The credit limits may be lower than what credit reports suggest, especially if the trade credit insurance company has other exposure to that client.

c) Factors may cut of a line off pre-emptively

Factoring companies watch their non-recourse lines very carefully. This monitoring is part of their usual risk management. They are likely to reduce or cut off a line if credits start going down.

8. Which type of invoice factoring is better?

In general, we consider both types of factoring to be about the same. You must balance the protections that non-recourse factoring offers against its limitations.

In most cases, the limitations of non-recourse factoring are aligned with your interests. Think about it this way – you really shouldn’t want to extend credit to customers that have a high financial risk. A good non-recourse factoring plan helps ensure this does not happen.

9. Are you looking for a factoring company?

If you are evaluating factoring companies, consider reading our guide on “How to choose the best factoring company for your business.”

Get a quote

We can provide competitive terms for recourse and non-recourse factoring plans. For information, get an online quote or call us toll-free at (877) 300 3258.

Disclaimer: This post is for informational purposes only. It does not intend to provide legal, financial, or insurance advice. If you require advice, please consult an expert.