When business owners negotiate with factoring companies, they usually focus on negotiating the best factoring rate. However, owners often don’t consider that the factoring rate is not the same as the factoring cost – at least, not on a “per-dollar” basis.

The factoring cost has two major components: the rate and the advance. Getting the best cost entails knowing how these two components work. This article discusses how costs work and provides negotiating strategies to get the lowest factoring cost. We cover:

- Understanding a factoring transaction

- What determines the factoring cost?

- Why is cost per dollar so important?

- How to negotiate the best factoring rate

- Conclusion

1. Understanding an invoice factoring transaction

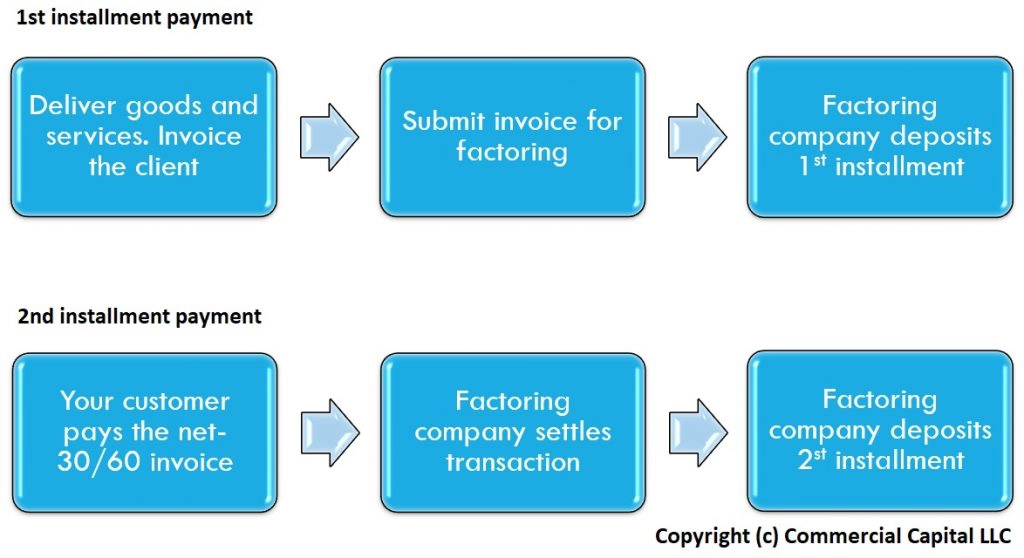

The first step to understand the cost of factoring is to learn how a transaction is structured. Most transactions are structured as a sale of accounts receivables. A client who needs to improve their cash flow sells their invoices to a factoring company. The factoring company buys the invoices at a small discount and pays and advances funds promptly.

Factoring companies usually buy receivables in two installments. The first installment is called the advance. The advance is the installment that improves your working capital. You get it immediately after factoring the invoice. It can cover 70% to 95% of the invoice value. Your company gets the second installment once the end customer pays the invoice. In most cases, this payment happens 30 to 60 days after submitting the invoice. At this time, the factor deposits the second installment to your bank account. This installment covers the amount that was not initially advanced, less the factoring cost. In summary:

- Submit invoices and get an advance of 70% to 95%

- Your client pays after 30 to 60 days

- Factor deposits the remaining 5% to 30% less the factoring fee

2. What determines the factoring cost?

The factoring fee is the percentage of the invoice that the factor keeps as payment for its service. It’s usually based on a percentage of the invoice’s face value. Let’s look at a simple example using an 80% advance and a 3% fee:

| Invoice Value | $100 |

| Factoring Advance | $80 ($100 x 80%) |

| Fee | $3 ($100 x 3%) |

A $3 fee gets you an $80 advance. However, using the “cost-per-dollar” method allows you to determine how much you pay for each dollar you are advanced. This method is a better way to determine the real cost of a factoring plan and compare factoring proposals.

Calculating the cost per dollar in cents is simple. Divide the rate by the advance and multiply the result by 100. For example, the cost per dollar in the previous example is 3.75 cents per dollar advanced. Divide 0.03 by 0.80 to get 0.0375 and multiply this figure by 100 to get 3.75 cents.

3. Why is the cost per dollar important?

The cost per dollar is important because it’s a way to “normalize” factoring proposals and determine which one is the better deal for you. More importantly, it prevents business owners from being persuaded to take a “seemingly low rate” that actually has a high cost. Let’s use another example. Consider these two offers, which one is cheaper?

| Option | Advance | Factoring Rate |

|---|---|---|

| Option #1 | 70% | 3.00% |

| Option #2 | 85% | 3.35% |

The first offer has the lower rate of 3%. From a rate perspective, that appears like the cheaper option. Now, let’s look at the cost per dollar of these offers:

| Option | Advance | Factoring Rate | Cost Per Dollar |

|---|---|---|---|

| Option #1 | 70% | 3.00% | 4.2 Cents |

| Option #2 | 85% | 3.35% | 3.9 Cents |

Note: Table can be scrolled left/right on mobile devices. Tap the screen if a scrollbar does not appear.

While the first offer has the lower rate, it also has the higher cost per dollar.

4. How to negotiate the best factoring cost

Negotiating the best factoring rate is not a matter of asking for the lowest possible rate. There are several preparations you should make to negotiate the best possible terms. Here are some:

a. Determine if factoring will actually help you

Factoring is designed to solve one very specific problem. It improves your cash flow if your cash flow problems are a result of slow-paying invoices. It won’t help you if you have cash flow problems due to other issues. The last thing you need is to pay for financing that won’t help you.

b. How much funding do you need?

Most clients approach factoring companies hoping to get as much funding as they can. This strategy can be a mistake. Getting too much financing only adds up costs without providing additional benefits. Examine your company’s actual needs and determine the advance percentage that would help your company. Don’t get more funds unless you can use them productively. A good rule of thumb is to get enough to cover costs, plus an extra amount as a cushion.

c. Lower the factor’s perceived risk

A well-run company often gets better factoring terms than a company that does not appear to be well-run. This is because well-run companies represent a lower risk to the factor. The following aspects affect how a factoring company views your company:

- Do you use bookkeeping software?

- Are your financial books up to date?

- Can you provide financial reports?

- Is your invoice aging report up to date?

- Do you follow good invoicing and collections practices?

Operating a well-run company gives you substantial leverage when negotiating with factoring companies. Cleaning up your company before applying for financing usually pays off.

d. Negotiate the lowest possible rate for the advance you need

Once you find the best factoring companies to help your business, evaluate their proposals carefully. The best strategy is to negotiate the lowest possible rate for the right factoring advance. If you followed the steps outlined in this article, you should already have this information available. This strategy helps get you funded at the lowest possible rate and for the lowest possible cost per dollar advanced.

e. Consider volume discounts

Factoring companies often provide better terms to companies that finance a minimum volume per month. Plans with no minimums are often a little more expensive. However, minimums can be a double-edged sword since you have to pay the fees even if you don’t reach the minimum. If your business has predictable revenues, agreeing to minimums could be to your advantage. Make sure you negotiate minimums that you can meet comfortably.

f. How long will you need to use factoring?

Some companies need factoring only for a few months to sort out temporary financial issues. Other companies need factoring for a longer time, usually to handle ongoing growth. If you think you will need factoring for a longer time (e.g., a year), consider using that as a negotiating advantage. Factoring companies are often willing to provide better terms to companies that will stay with them for a year or longer.

5. Conclusion

Consider the whole picture when negotiating a factoring plan. Focusing on low rates doesn’t always get you a cost-effective plan. The factor advance plays an important role in your cost of funds. Follow the steps in the previous section to help you negotiate the best factoring terms.

Get more information

We can provide you with the best factoring rates. For information, get an instant quote or call (877) 300 3258.

Disclaimer: This article oversimplifies the complex matter of negotiating the cost of business financing. It does not intend to replace the advice of a financial or legal professional. As a matter of fact, we encourage you to seek financial and legal advice from competent professionals who are familiar with your circumstances.