Summary: This article is written for owner-operators and small fleet owners. It teaches you one thing: how to choose the state where you buy your fuel so that you can buy it at the lowest possible price. This simple strategy can help you increase your profits without changing the miles that you drive. We cover the following:

- How is fuel taxed in the trucking industry?

- How does IFTA work?

- Forget the pump price. Focus on the pre-tax price

- How to pay for fuel if cash is tight?

- Keeping track of expenses

Most owner-operators buy their fuel in the state that offers the lowest pump prices. However, this strategy often leads to them paying more for fuel. We know this assertion seems counter-intuitive. It will make more sense when you understand how transportation companies are taxed for fuel.

1. How is fuel taxed in the trucking industry?

For owner-operators and some small fleets, fuel is the largest variable cost. Unfortunately, it is also one of the most confusing costs for beginning (and some experienced) owner-operators.

Each state sells fuel at a different price and taxes the fuel at its own rate. To complicate matters, the International Fuel Tax Agreement (IFTA) requires that you pay taxes to each state (or Canadian province) that you drive through regardless of where you bought the fuel. Specifically, you have to pay for the fuel consumed (and miles traveled, in some cases) in their jurisdiction.

2. How does IFTA Work?

Simply stated, IFTA is a system that allows you to calculate and pay for fuel taxes in a simple way. The fuel taxes that you pay when you buy fuel are credited to your IFTA account. At the end of the quarter, you list the miles traveled and gallons purchased in each jurisdiction.

Lastly, you calculate if taxes are due, or if you are owed a refund. This last point is crucial – you can also get refunds. Note that some states have additional surcharges (per-mile, etc.). While these charges are important for tax purposes, they should not usually affect the decision of where you buy your fuel.

3. Forget the pump price. It’s the pre-tax price

Most owner-operators try to save money by purchasing fuel at the truck stop with the lowest pump price. This choice seems reasonable, right? We are trained to buy things at the lowest list price.

However, purchasing diesel fuel is different for truckers. As mentioned before, you have to pay fuel taxes to every jurisdiction that you drove through regardless of where you purchased it. Consequently, you have to look at fuel purchases differently.

This concept is easier to explain with an example. Let’s assume you have the option of buying fuel in Illinois or in Missouri. Here are the per-gallon pump prices from a few years ago:

- Illinois: $3.399

- Missouri: $3.259

Where would you buy your fuel? At first glance, Missouri has the cheaper fuel. Seems like the obvious choice, right? Let’s look at the same numbers, but with more details:

- Illinois: $3.399 ($2.972 pre-tax + $0.427 tax)

- Missouri: $3.259 ($3.089 pre-tax + $0.170 tax)

Although Missouri has the cheaper pump price, Illinois has the cheaper pre-tax price. Illinois is the better deal because you are paying a lower BASE PRICE for the fuel. Then, using your IFTA calculations, you can add the relevant taxes later, as required.

Below is a detailed comparison of this example. It shows a 100-mile trip, with 50 miles driven in Illinois and 50 miles driven in Missouri. In one case, the trucker buys the fuel in Illinois. In the other case, the trucker buys the fuel in Missouri.

The summary section below shows that buying fuel in Illinois is the better choice. While Illinois has a higher pump price, it has a lower base price. Ultimately, purchasing fuel in Illinois produces a savings of $2.340 for the trip.

Here is the financial summary:

| Item | Missouri | Illinois |

|---|---|---|

| Fuel Cost | $65.18 | $67.98 |

| IFTA – Due / (Rebate) | $2.57 | ($2.57) |

| Actual Fuel Cost | $67.75 | $65.41 |

| Savings | $2.34 |

This is how we arrive at the information in the above table (Financial Summary). This table shows the trip details.

| Item | Missouri | Illinois |

|---|---|---|

| Miles per Gallon | 5 | 5 |

| Miles | 50 | 50 |

| Gallons | 10 | 10 |

The following table shows the pump price at Missouri and Illinois. It also shows the tax information, which we use to arrive at the pre-tax fuel price.

| Item | Missouri | Illinois |

|---|---|---|

| Pump Price | $3.259 | $3.399 |

| Tax Percentage | 5.22 % | 12.56 % |

| Tax | $0.170 | $0.427 |

| Pre-Tax Fuel price | $3.098 | $2.972 |

Note that while Illinois has a higher cost at the fuel pump, it has a lower pre-tax cost than Illinois.

This last table shows we how we determined whether we would have to pay an additional tax, or get a rebate based on where we buy the fuel. Consider using a calculator when you look at the table so you understand where every number came from.

| Item | Buy in Missouri | Buy in Illinois |

|---|---|---|

| Pump Price | $3.259 | $3.399 |

| Gallons | 20 | 20 |

| Paid at Pump | $65.18 | $67.98 |

| Tax per Gallon | $0.17 | $0.427 |

| Total Missouri Tax Paid | $3.40 | $0.00 |

| Missouri Tax Due | $1.70 | $1.70 |

| Missouri Pay / (Rebate) | ($1.70) | $1.70 |

| Total Illinois Tax Paid | $0.00 | $8.54 |

| Illinois Tax Due | $4.27 | $4.27 |

| Illinois Pay / (Rebate) | $4.27 | ($4.27) |

| Settlement Pay / (Rebate) | $2.57 $4.27 – 1.7 = $2.57 | ($2.57) $1.7 – $4.27 = -$2.57 |

Note: The table can be scrolled left / right on mobile devices. Touch the table if a scrollbar does not appear.

Using the above example, you can see how quickly the numbers add up when you drive thousands of miles every month. Using this strategy, you could rack up huge savings that simply drop to your bottom line as profit. Here is a list of fuel tax rates by state.

Obviously, few owner-operators have a situation as simple as the one outlined above. The reality is that you have to drive through many states, each with its own specific costs (Note that we got the information for this example from our colleagues at Learn to Truck).

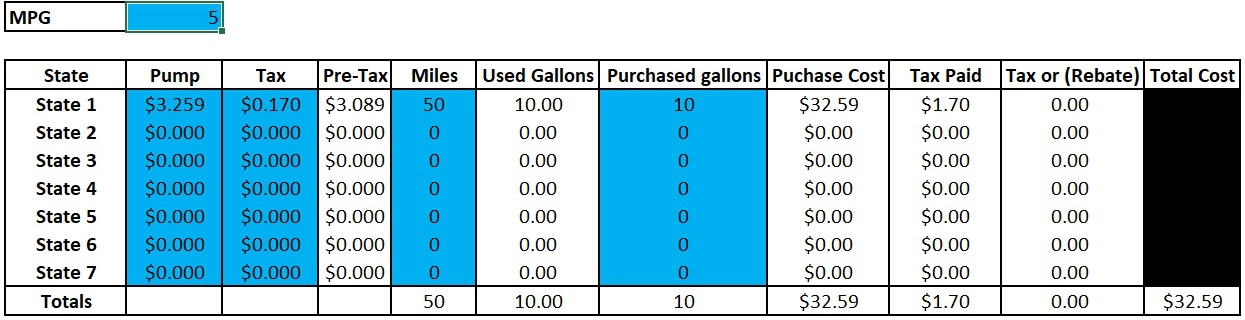

We have created a simple calculator for estimating your costs (or savings) based on different fuel purchasing strategies. It was developed as a learning tool. Use it to familiarize yourself with fuel costs. Here is a screenshot.

Here is a link to the calculator: Fuel savings calculator (Excel file).

4. How to pay for fuel if cash is tight

Paying for fuel can be a challenge for new and growing owner-operators. It is one of your highest (if not the highest) variable expenses, and you have to pay for it up front.

If you need funds for fuel, or if cash is tight due to slow broker/shipper payments, consider freight factoring. Factoring provides you with a high advance for your slow-paying invoices. This solution gives you the cash to pay for expenses, including fuel.

Furthermore, our factoring programs can provide a fuel advance if you need it. This feature is useful if you need funds to pay for fuel so that you can pull a load.

5. Keeping track of expenses

Successful owner-operators are good at tracking their expenses. When it comes to fuel, the law requires it. TruckBytes offers a free “basic software package” that helps you manage your trucking business. They also offer (paid) upgrades that provide IFTA services among other benefits. This tool can be invaluable to new owner-operators.

Note: This article is part of a series on how to make successful trucking companies.

Need money for fuel or brokers paying slowly?

We can provide immediate cash flow with our factoring program. Get an instant online quote, or call (877) 300 3258.