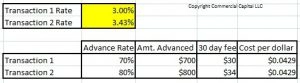

Most people use a simple approach when comparing proposals from competing factoring companies. They make their decision based on who offers the lowest rate and the lowest application fee. While this strategy is common, it can lead to making a wrong decision. This is because the lowest rate does not always equal the lowest cost, […]

Application Tips

The True Cost of Factoring – Why Focusing on Rate Alone is Wrong

One of the bigger mistakes that prospects make when negotiating a factoring agreement is focusing their discussions on the rate alone, rather than focusing on the total cost of the service. While it’s true that the rate can sometimes be a good measure of total cost in many financing transactions, that is not the case […]

How to Check Your Client’s Business Credit (Commercial Credit)

Most companies that sell products or services to commercial customers have to offer payment terms – the option to pay invoices in net 30 to net 60 days. Many customers will do business with you only if you are willing to offer these terms. The problem is that not every company is creditworthy and deserving […]

Is Switching Factoring Companies the Right Choice for You?

The decision to change factoring companies should be made only after carefully evaluating the pros and cons. Many business owners underestimate the potential complexity of switching finance companies. This oversight can lead to problems that could have been avoided with proper planning. This article explains how the process works, common reasons for changing finance companies, […]

Improve Your Factoring Application with an Executive Summary

Invoice factoring is commonly used by business owners trying to turn their companies around. In these situations, getting financing is essential for the company’s survival. You can improve your chances of approval by including an executive summary with your application. This article discusses the factoring due diligence process and how an executive summary increases your […]

How to Choose the Best Factoring Company

Selecting a factoring company is one of the most important financial decisions that you will make for your business. This article explains everything you need to know so you can find and select the best factoring company for your business. We cover the following: What is a factoring company? How does factoring work? Recourse vs […]

Factoring Application Mistakes to Avoid

Four common application mistakes can lead to a funding delay or a rejection of your factoring application. This article provides suggestions to avoid these mistakes and improve your chances of getting funding. Lastly, we provide a strategy to handle transactions in which the company (or owner) has negative information. Mistake #1 – Hard-to-read applications Submitting […]

Eight Factoring Application Roadblocks

Most factoring applications can proceed quickly if a prospective client does not have significant problems. However, open liens, legal issues, or tax problems affect your chances of getting funding. Knowing how to handle these problems ahead of time improves your chances of success. Here are the eight most common roadblocks to having your factoring application […]

What to Do If Your Invoice Factoring Application Is Rejected

Having a finance company reject your application is always difficult. However, knowing how to handle the rejection effectively may help you get financing in the future. This article covers how to handle an application rejection constructively. It covers the most common reasons factoring applications get rejected and provides a strategy to move forward. 1. How […]

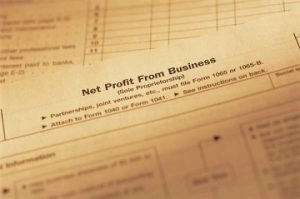

Why Do Factoring Companies Ask for Tax Documents?

Prospective clients are often surprised when a factoring company asks for copies of their tax documents during the application process. Factoring companies may ask for the following documents where applicable: IRS Form 941 Federal tax returns State tax returns A prospective client’s confusion about this requirement is understandable. After all, why does a company that […]