Summary: A heavy debt load can leave a small business vulnerable to financial problems. The business won’t be able to respond to changing market conditions or business emergencies. Unfortunately, many small and midsized companies fail due to excessive debt. Everyone agrees that too much debt is bad. Despite this, there is disagreement over the amount […]

Business Cash Advance

Business Cash Advance vs. Invoice Factoring – Which is Better?

As a business owner, you want to use the right financing tool to solve your problems. This article helps you do that. We compare two common business financing tools: business cash advances and invoice factoring. This article helps you determine if either solution is right for you. In this article, you learn: What a cash […]

How to Get Out of Merchant Cash Advance Loans

Merchant cash advances have become a very popular form of financing among business owners. They are easy to get and set up. Their apparent convenience attracts companies that don’t want to go through the conventional lending process. There is one catch The speed and convenience of cash advances come at a steep price. These loans […]

Why You Shouldn’t Refinance an MCA with a Cash Advance

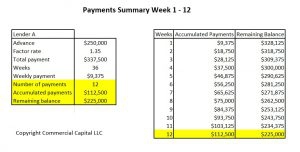

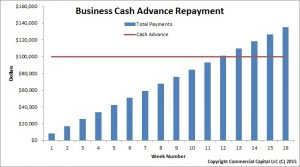

Merchant cash advances are a popular but very expensive form of business financing. Companies that have excessive cash advance debt often look to refinance (or consolidate) these loans to escape from their high weekly cost. In this article, we take you through a merchant cash advance refinancing transaction and discuss why merchant cash advances are […]

Should You Refinance Your Merchant Cash Advance? How?

Companies that struggle with their merchant cash advance (MCA) debt often consider using debt refinancing. They anticipate that this option will solve their financial problems. However, the decision to refinance debt isn’t easy. Using the wrong product to refinance your debt can leave you worse off. If done incorrectly, it could lead to the failure […]

How Does a Business Cash Advance Loan Work?

Merchant cash advances (MCAs) have been gaining popularity in recent years. The product started as a solution to finance future credit card sales. However, this product has evolved into a solution that allows companies to finance future sales of almost any kind. The term business cash advance is probably a better description. From this article you will learn: […]

Merchant Cash Advance Pros and Cons

Merchant cash advances (MCAs) have become a popular way to finance a small business. This solution allows you to finance future sales and get funded quickly. As a result, an MCA can be a useful option in certain circumstances. Like any financial product, merchant cash advances have both advantages and disadvantages. This article helps you understand the […]

What is a Merchant Cash Advance?

A merchant cash advance (MCA) is a form of financing that allows a company to sell a portion of its future sales in exchange for an immediate payment. This financing provides your company with funds to pay operational expenses and to grow. There are a few ways to repay the financing line, depending on your type of business. […]

Is Invoice Factoring Better Than a Business Cash Advance?

In recent years, a type of Merchant Cash Advance known as a Business Cash Advance has been gaining popularity as a way to finance small businesses. Often, companies compare business cash advances against other products, such as factoring and purchase order financing, to determine which offers the best solution to their problems. This article compares […]