Most established companies get credit terms from their suppliers. This credit enables companies to buy goods or services while paying the supplier on net-30 to net-60 terms. Clients usually demand payment terms from their suppliers because it improves their cash flow. They get to use the supplier’s services or products for a few weeks before […]

Business Financing

Is Invoice Factoring Better Than a Business Cash Advance?

In recent years, a type of Merchant Cash Advance known as a Business Cash Advance has been gaining popularity as a way to finance small businesses. Often, companies compare business cash advances against other products, such as factoring and purchase order financing, to determine which offers the best solution to their problems. This article compares […]

Should You Offer Early Payment Discounts? (2% / 10 Net 30)

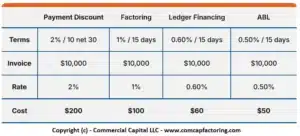

An early payment discount is an incentive that companies receive from suppliers in exchange for a quick payment. It is usually offered by suppliers that need to improve their cash position. In this article, we discuss: 1. Why do you need early payment discounts? Selling to commercial clients can be a challenge for small and […]

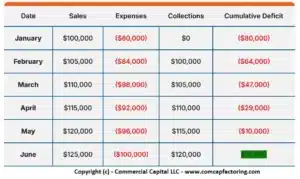

Cash Flow Problems Due to Growth

Sales growth has to be managed correctly, or it can actually bring serious problems to a company. Few entrepreneurs ever consider this outcome because they believe all growth is good. But growing sales too quickly, or getting several very large orders, can create serious cash flow problems. These problems can sometimes be severe enough to […]

12 Cash Flow Problems and Solutions

Most small businesses encounter a cash flow problem at one time or another. Fortunately, most cash flow problems can be prevented with a bit of preparation and the right strategy. This article lists the 12 most common causes of cash flow problems, along with ways to solve them. 1. Not having a cash reserve Most […]

13 Ways to Finance a Business

Every year, thousands of business owners look for financing to either start or grow a company. Unfortunately, getting small business financing is difficult. It often requires entrepreneurs to try several alternatives before they find the right solution. This short guide addresses the most common ways to finance your business. It includes some important caveats to […]

How to Check Your Client’s Business Credit (Commercial Credit)

Most companies that sell products or services to commercial customers have to offer payment terms – the option to pay invoices in net 30 to net 60 days. Many customers will do business with you only if you are willing to offer these terms. The problem is that not every company is creditworthy and deserving […]

How To Leverage Early Payment Discounts (Increase Profits)

Many business owners complain of cash flow problems. However, a few companies actually have the opposite situation. They have excellent cash flow. In fact, they have more cash than they need to run their everyday operations. This scenario provides a great opportunity to increase profits. Companies with excess cash flow can use it to increase […]

Business Financing for Companies with Tax Problems

Summary: Running a company that is behind in taxes is very difficult. In most cases, the company has cash flow problems, is behind paying its suppliers, and is at risk of failing. Some companies with tax problems can be turned around with the right type of financing. However, getting funding will be very difficult. This […]

Emergency Cash Flow Financing

Many small businesses have a cash flow emergency at one point or another. Unfortunately, these emergencies can even happen to companies that are well prepared. This article shows you how to obtain financing if your company needs immediate emergency funding. It also explains how to prevent some emergencies. We cover: 1. What is causing your […]