Non-recourse invoice factoring plans have quickly become very popular with companies that are looking for a factoring plan. The main advantage of non-recourse plans is that the factoring company absorbs the loss of advance, if your customer does not pay due to a credit reason. Factoring companies use different rules to define what is a qualifying ‘credit reason’. […]

Invoice Factoring

How Much Does Factoring Cost?

This article explains how to calculate the factoring fees of a factoring proposal. It covers the three most common proposal fee types: flat-rate, variable-rate, and discount-plus-margin. We cover the following: 1. How does factoring work? This article assumes that you are already familiar with factoring and know how it works. Here is a short summary […]

How to Evaluate Factoring Companies

The decision to use factoring to improve the cash flow of your company is not easy and should be done carefully. The success of your business depends on making the right choice and partnering with the right company. In this article, we discuss how to evaluate factoring companies effectively. The process is simple to use […]

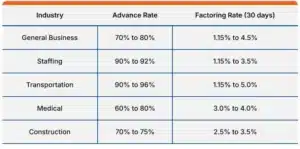

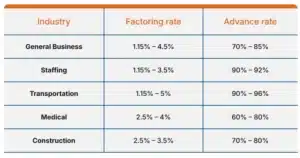

Typical Factoring Rates

In this article, we discuss factoring rates and how to use rates to determine the total cost of using this solution. From this article, you will learn: If you are not familiar with factoring, consider reading “How does factoring work?” before reading this article. If you just want an instant rate quote, try this form. […]

Do You Qualify For Invoice Factoring?

Factoring plans can provide many of the benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing. Most factoring companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice factoring. Note: To learn more about factoring, read […]

Invoice Factoring with No Minimums

Factoring plans often include minimum financing requirements. Committing to a minimum funding volume can help you get better factoring rates. However, it can also hurt your company if your minimums are not managed correctly. Most small and growing companies should consider factoring plans with no minimums, at least initially. From this article, you will learn: […]

What is Invoice Financing? How Does it Work?

Invoice financing is a general term that applies to several products that allow you to finance accounts receivable. The two most-used solutions are factoring and sales ledger financing. In this article, we discuss both solutions in detail. The article covers: 1. Quick Summary Factoring allows your company to sell its invoices to improve your cash […]

Inventory Financing vs. Accounts Receivable Factoring

Summary: Invoice factoring allows companies to improve cash flow by leveraging their accounts receivable. Inventory financing, on the other hand, enables companies to leverage the funds tied to their inventory. However, most small business owners misunderstand each solution’s role in their company. This misunderstanding often leads to expensive mistakes. Invoice factoring is more flexible and […]

Using Invoice Factoring to Finance Startups

Summary: Finding the right source of financing for a startup is one of the most challenging tasks for founders. Guided by what they see in the popular media, founders often think that the best way to finance a company is with venture financing, angel financing, or a business loan. This is not the case. Few […]

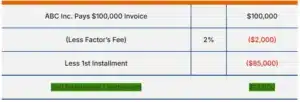

Invoice Factoring Examples (With Complete Details)

Summary: This article offers two examples of how invoice factoring transactions work. It helps you understand how the account is funded, how fees are charged, and how the transaction is settled. The article covers the following subjects: 1. What is invoice factoring? Factoring is a tool that helps companies that have cash flow problems due […]