A cash reserve is a set of funds that a company puts aside to handle financial challenges. It is one of the most important financial resources that a company can develop. A reserve provides financial stability and allows you to operate the business more effectively. Unfortunately, many business owners ignore the importance of having a […]

Frequently Asked Questions

How Much Debt Can Your Company Handle Safely?

Summary: A heavy debt load can leave a small business vulnerable to financial problems. The business won’t be able to respond to changing market conditions or business emergencies. Unfortunately, many small and midsized companies fail due to excessive debt. Everyone agrees that too much debt is bad. Despite this, there is disagreement over the amount […]

How to Offer Net-30 Terms Effectively

Summary: Waiting 30, 45, or even 60 days to get an invoice paid is a challenge for many business owners. Small companies often have to wait for payment because their commercial sales are made on credit. This type of trade credit is commonly known as “payment terms.” Companies must offer payment terms because their clients […]

Why Do Companies Use Factoring?

Factoring is a product that helps companies that have slow-paying clients. These companies usually can’t wait 30 to 60 days to get paid by clients. Factoring solves this problem by financing their invoices. It provides businesses with cash that they can use to run the business. Companies often use the funds from factoring to: 1. […]

How Do PO Finance Companies Pay Suppliers?

Purchase order financing helps small companies with the supplier costs associated with a large order. It enables small business owners to fulfill large orders and book the revenue. This article discusses how purchase order finance companies pay your supplier expenses. We cover: For more information, read “What is Purchase Order Financing? How Does it Work?“ […]

The Best Way to Collect Unpaid Invoices

Summary: Collecting unpaid invoices is probably one of the most tedious tasks of running a business. However, it’s also the most important one. Getting paid on time is vital to the success of a company. It brings in the money to pay employees, suppliers, rent, and yourself. Consequently, it’s essential to handle collections well from […]

How Does Accounts Receivable Financing Work?

Companies that work with commercial clients often have to wait 30 to 60 days before getting paid. This practice is known as offering “net terms” and is common in commercial and government sales, where clients often demand terms as a condition of awarding a contract. Offering terms creates a dilemma for companies that don’t have […]

How to Get Credit from Suppliers

Most established companies get credit terms from their suppliers. This credit enables companies to buy goods or services while paying the supplier on net-30 to net-60 terms. Clients usually demand payment terms from their suppliers because it improves their cash flow. They get to use the supplier’s services or products for a few weeks before […]

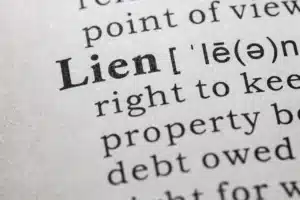

How is a Subordination Used in Invoice Factoring?

Summary: In most cases, setting up a factoring account is relatively simple. Once the factoring contracts are signed, the factor files a UCC lien to secure its position against the accounts receivable, sends notices of assignment, and starts funding the account. Usually, this process is done fairly quickly. Having an existing UCC lien claiming your accounts receivable as […]

What is a Factoring Company?

Summary: Factoring companies provide financing to businesses that have cash flow problems. They specialize in financing accounts receivable, which improves the client’s cash flow. Smaller factoring companies typically provide invoice factoring as their only service. However, larger providers typically offer additional products, such as ledgered lines of credit, supply chain financing, and asset-based loans. This […]