Getting a factoring line if you already have financing in place is difficult. Factoring companies can finance your invoices only after they secure a first UCC position on your accounts receivables. This requirement often conflicts with your current lender’s collateral position. This article explains how loans and factoring lines are secured and provides the criteria […]

Frequently Asked Questions

Understanding the Factoring Rebate

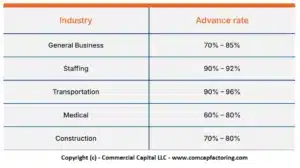

Most factoring transactions are structured as the purchase of an invoice in two installments. The first installment, usually 70% to 90% of the invoice, is the factoring advance. The second installment, the remaining 15% to 30% (less fees), is the rebate and is usually paid once the customer pays the invoice in full. At least, that […]

What is the Factoring Advance?

Most clients are initially perplexed to hear that the factoring advance, which is paid as soon as the invoice is sent to the factoring company, is less than the full value of the invoice. Most factoring companies advance between 70% and 90% as a first installment and hold 10% to 30% of the invoice as […]

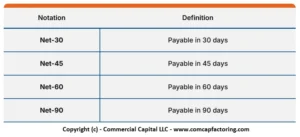

What Are Net-30 Terms? How Do They Work?

Summary: Most commercial transactions use payment terms, typically referred to as offering “Net 30 – 60 days.” These terms are a form of credit that typically gives clients 30 to 60 days to pay an invoice. Companies must offer payment terms if they want to remain competitive, especially when bidding for large opportunities. However, offering […]