There is a large market opportunity for US and Canadian companies that export timber, usually as logs, to Europe and Asia. Although timber is a commodity, some types of wood – especially high-demand specialty hardwoods – can command high profit margins. The combination of high demand and decent profit margins makes these transactions very appealing. However, […]

Purchase Order Financing

How to Choose the Best PO Financing Company

The market is full of companies that advertise purchase order (PO) financing programs. However, only a few companies have the experience, knowledge, and capital to handle these transactions successfully. Choosing the right finance company is important because it plays a critical role in the outcome of your transaction. In this article, we discuss: 1. What […]

Advantages and Disadvantages of Purchase Order Financing

In recent years, purchase order (PO) financing has been gaining popularity as a tool to finance companies that have been awarded a large purchase order. In this article, we discuss: 1. What is purchase order financing? Purchase order financing helps distributors and resellers that need funds to fulfill large purchase orders. The solution helps pay […]

What is Purchase Order Financing? How Does it Work?

Summary: Purchase order (PO) financing helps small businesses that have a large order and need funds to pay their vendors. It helps cover your supplier expense, enabling you to fulfill the order and book the revenue. While this solution is flexible, it works only with specific transactions. This article explains how PO financing works, who […]

Purchase Order Financing Qualification Requirements

Purchase order (PO) financing has been gaining popularity as a tool to fund large purchase orders. However, many prospective clients often misunderstand what is needed to qualify for this solution. Clients often believe that they only need a substantial purchase order to qualify. Unfortunately, this assumption is wrong. Transactions often have a lot of moving […]

How do Purchase Order Financing Companies Prepay Foreign Suppliers? (Letter of Credit)

Most of our purchase order (PO) financing clients are importers who buy goods from another country and sell them to companies in the US or Canada. Some of these importers usually request that we prepay their supplier by wire transfer. While purchase order financing companies can pay foreign suppliers with a letter of credit, documentary collection, […]

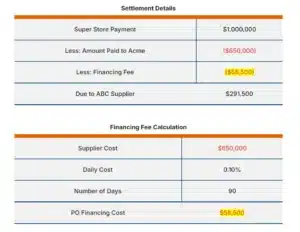

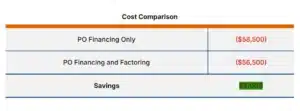

Should You Use Factoring with Purchase Order Financing?

Summary: Purchase order (PO) financing companies often advise prospective clients to work jointly with a factoring company. Combining both products can reduce the total financing cost of a transaction and provide additional capital to the company. However, settling a transaction through a factoring line only benefits some transactions. This article explains how a purchase order […]

Who Can Use Purchase Order Financing?

Purchase order (PO) financing is a flexible product that can help small companies handle large sales. However, PO funding has some limitations and is not for every company. This article helps you understand PO financing and determine if your company is a good candidate for it. The following topics are discussed: 1. What is purchase […]

How Purchase Order Financing Can Help Resellers and Wholesalers

Most wholesalers and resellers have a relatively simple business model: they buy goods from suppliers (local or foreign) and resell them at a markup to corporate clients. Although the business model may be simple, running this type of a business is not easy. Managing the cash flow can be difficult, which can limit your ability to […]

Financing An Import Business with Purchase Order Funding

Product importers are accustomed to dealing with long, grueling cash flow cycles. On one hand, foreign suppliers often demand prepayment before manufacturing and shipping an order. This requirement is often non-negotiable. However, prepaying suppliers often ties your funds for 30 to 60 days, depending on their manufacturing schedules and shipping time frames. On the other hand, if […]