Selling products to the US government can be lucrative, especially for small business owners who qualify for the 8(a) program. This program offers several opportunities to companies that meet its criteria – usually small businesses, minority-owned businesses, and women-owned businesses.

Product contracts often have large values that exceed the financial capabilities of small government vendors. However, many small companies that get a government contract often lack the working capital to deliver it. These small businesses face a dilemma: they can win the orders, but they cannot fulfill them. In this article, we discuss how to solve this problem. We cover:

- What is purchase order financing?

- How does it work?

- Who qualifies for PO financing?

- Advantages and limitations

- How to finance manufacturing orders?

- Conclusion

1. What is purchase order financing?

One of the advantages of becoming a government contractor is that government agencies often place large orders. While large orders present great opportunities, they can also challenge small business owners.

Small businesses that sell products to the government often have to pre-pay their suppliers for the order. However, large orders can exceed the cash reserves of the business. This situation leaves the small government vendor unable to fulfill the order without financing.

Purchase order financing bridges this gap by handling the supplier pre-payment. This funding allows the supplier to deliver the goods, enabling the business owner to fulfill the order and book the sale.

2. How does it work?

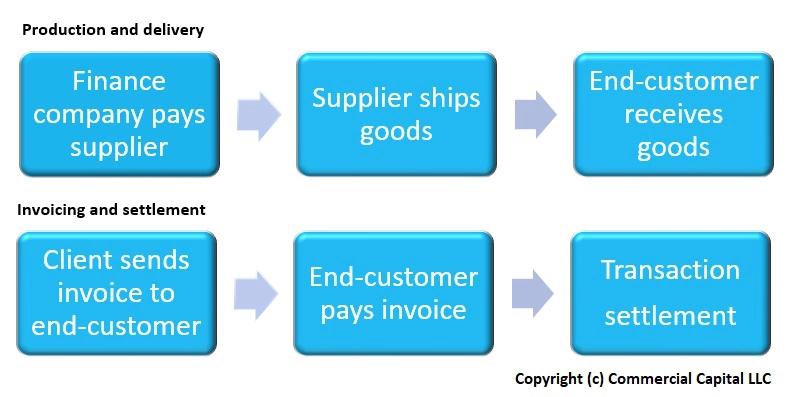

The solution works by partnering with a finance company that can handle your supplier payment. Transactions are relatively simple and take a couple of weeks to set up. Purchase order funding works as follows:

- You sign on with a finance company

- The finance company reviews the order to determine if it qualifies

- The finance company pays your supplier

- Your supplier delivers the goods to the government (after inspection)

- You invoice the government

- Once the government pays, the transaction settles

The following graphic shows a summary of how a transaction works.

For more information, read “What is Purchase Order Financing? How Does it Work?”

a) Costs

The cost to finance a purchase order varies based on the size of the order and the reputation of the supplier. Rates average 3% per 30 days but can be higher or lower based on transaction risk. Learn more about PO financing rates.

b) Assignment of claims act

The government allows purchase orders to be financed through the Assignment of Claims Act. Although the performance of the contract may not be assignable to another party, the revenues from the contract can often be assigned. The Assignment of Claims Act allows you to finance your purchase orders as long as you follow the rules.

3. Who qualifies for PO financing?

Qualifying for purchase order financing is easier than obtaining other types of financing. These are the most important qualification requirements:

- You must buy and then resell products without any modifications or customizations

- Your company must not directly manufacture the products that you sell

- Your gross margins must be at least 20%

- Your suppliers must have a good track record of delivering products and are in good financial shape

- Your purchase orders must not be non-cancellable and have no consignment or guaranteed sale terms

- Your orders must be for a minimum of $100,000

4. Advantages and limitations

Purchase order financing has advantages and limitations that government vendors need to consider.

a) Advantages

The main advantages of the solution include:

- Allows you to take on larger orders

- Easier to get than bank financing

- Grows with your business

- Can cover up to 100% of supplier costs (if margins are above 30%)

b) Limitations

Purchase order financing has some limitations and is not the right solution for everyone. Here are the most important limitations.

i) Can be used only in high-margin transactions

The most important limitation of purchase order financing is its cost. Consequently, the solution should be used only in transactions that have relatively high margins of 20% to 30%. Many government orders are for high volumes at low margins but can have margins as low as 10%. Unfortunately, PO financing is not the right solution for these transactions.

ii) Cannot be used by manufacturing companies

This solution helps only a narrow set of companies and cannot be used by manufacturing companies.

iii) Cannot be used by service providers

Service providers cannot use PO financing. This is because PO financing covers only supplier expenses. Service providers should consider using invoice factoring. For more information, learn about factoring.

5. How are manufacturing companies financed?

Manufacturing companies cannot use purchase order funding. However, manufacturing companies have the option of using supplier financing. Supplier financing provides the same benefits as purchase order financing but offers more flexibility. However, the qualification requirements for supplier financing are more stringent than the requirements for PO financing.

6. Conclusion

Purchase order financing can be an excellent solution for small and midsize distributors and re-sellers that sell products to the government. Manufacturing companies that can’t get PO financing should consider supplier financing. Lastly, service providers should consider using invoice factoring.

Learn more

If you would like a PO financing quote, fill out this form or call us at (877) 300 3258.