Merchant cash advances (MCAs) have been gaining popularity in recent years. The product started as a solution to finance future credit card sales. However, this product has evolved into a solution that allows companies to finance future sales of almost any kind. The term business cash advance is probably a better description.

From this article you will learn:

- What a business cash advance loan is

- How the payback amount is calculated

- How the cash advance loan is paid back

- Pros and cons of this solution

- Alternatives that may work better

- Get advice before moving forward

1. What is a business cash advance loan?

The premise behind a merchant cash advance, or a business cash advance, is that you can sell your future sales and get funded quickly. With this short-term solution, payback usually happens in months.

Repayment often begins immediately. The cash advance provider either takes a portion of your ongoing sales, or it debits your bank account every business day.

Due to this structure, the product is more similar to a short-term loan than a line of credit. Although this product is often referred to as a business cash advance loan, providers often state that the product itself is not a loan. They state that it is the sale of a future asset. Learn more about merchant cash advances.

a) Credit card sales vs. commercial sales

Business cash advances can be used to finance most types of future sales. Credit card transactions are one of the most commonly funded types of sales because repayment, from the lender’s perspective, is easy.

However, companies can also finance future cash sales or net-30 commercial sales. The repayment method on these transactions, however, is different and is explained in the following sections.

b) How is the funding amount calculated?

The cash advance provider determines how much to advance your company by reviewing your past sales. The provider reviews past credit card transactions or analyzes your bank statements. Most cash advance companies fund anywhere from 80% to 150% of your average monthly sales. This amount varies by provider and is also based on the financial strength of your company.

2. How is the payback amount calculated?

The amount that must be repaid ranges from 9% to 50% more than the amount that was funded. Cash advance providers call this amount a factor, which ranges from 1.09 to 1.50. The payback is determined by multiplying the factor by the advanced amount.

For example, a cash advance of $100,000 with a factor of 1.35 requires a $135,000 payback. In this case, you repay 35% more than the amount you got.

Most cash advance transactions are short-term, usually 3 months to 15 months. To calculate the APR of the transaction, you need to consider both the cash advance factor and the repayment term. As you can imagine, the APR is much higher than that of a regular business loan.

3. How is the cash advance loan repaid?

Repayment of a cash advance is somewhat similar to that of a term loan. You get the funds upfront, and then you make regular payments until the outstanding balance is paid off.

Advances based on credit card sales are repaid by sharing your future daily revenues with the cash advance company. The percentage rate of your revenues paid to the cash advance company is called the “retrieval rate.” Retrieval rates range from 8% to 13% of your sales and are handled by using split processing with your card processing company.

Advances on regular sales are repaid through bank account debits. The cash advance company debits a fixed amount from your bank account every business day until the funds are paid off.

a) Sample cash advance transaction

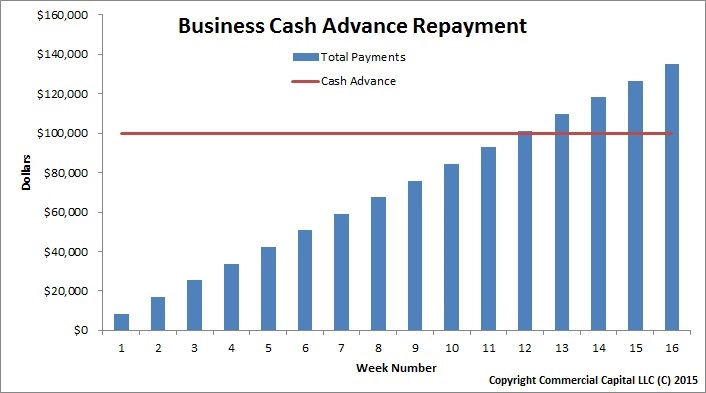

Here is a simplified example of a cash advance. Assume the following:

- Advance: $100,000

- Factor: 1.35

- Total repayment amount: $135,000

- Repayment period: 4 months (weekly payment)

- Weekly payback: $8437.50

The following chart shows the cumulative weekly payments for the $100,000 cash advance. The repayment chart would be different for a credit card merchant cash advance because it uses a revenue split, rather than a fixed payment. However, the results are similar.

4. Advantages and disadvantages

Like any financial product, business cash advance loans have advantages and disadvantages. Perhaps the biggest disadvantage is that this product is often used to solve the wrong problem. For example, companies that have ongoing cash flow problems (often due to slow-paying clients) won’t usually get long-term benefits from a short-term solution because of how the solution is structured. Here is one way to look at it. As you can see in the graph, you start with $100,000 of availability. However, you lose $8437.50 in availability every week. By week #6, you have repaid a little over $50,000 and lost half of your availability. By week #13, you have lost all availability and will only be paying back fees.

Additionally, cash advances are very expensive. Unless your business has high profit margins, cash advances could wipe out profits temporarily. In some cases, the payment schedule of the cash advance can get the company get into new financial problems. Business owners often respond to this situation by getting a second cash advance loan. The second loan helps them meet the payment obligations of the first loan. It also provides some funds for the business. But the help is temporary.

Soon enough, the company runs into the same financial problems again, and gets a third ACH loan. The third loan is used to meet the payment obligations of the first two cash advances. You can see where this is going. It’s a financial tail spin.

Having multiple cash advance loans is called ‘stacking’ and is very risky. It often leads to business failure unless the loans are paid off through debt consolidation or some other means.

However, this product does have some important advantages. It’s much easier to get than a bank loan or similar product. And most accounts can get approved and funded within days. This quick turnaround makes cash advances a solution for companies that have very urgent needs. Also, a business cash advance loan could work if your company has an opportunity with a quick payoff.

5. Alternative solutions

One alternative solution that can work well for small business owners is an SBA Microloan. This program can provide up to $50,000 and is available to business owners who have little or no credit. Loans often come bundled with training and consulting, which can be very useful for small business owners.

Alternatively, if you sell to commercial clients and have problems because they pay you in 30 to 60 days, consider factoring your invoices. A factoring program allows you to finance slow-paying invoices, which improves your cash flow. This type of financing is ongoing and relatively easy to get. The factoring line can increase as your sales to commercial clients grow.

You can find more small business financing alternatives here.

6. Get advice

Consider getting financial advice from a professional, such as a CPA or a member of SCORE, before getting a business cash advance loan. Actually, consider getting this advice regardless of what type of financing you get. This advice helps ensure that the financial program is a good match for your business.

Do you need financing?

We are a leading provider of invoice factoring, an alternative to business cash advance loans. For information, fill out this form or call us toll-free at (877) 300 3258.

Note: We do not offer business cash advances. This article should not be considered financial advice and is provided for informational purposes only.