Merchant cash advances have become a very popular form of financing among business owners. They are easy to get and set up. Their apparent convenience attracts companies that don’t want to go through the conventional lending process.

There is one catch

The speed and convenience of cash advances come at a steep price. These loans are very expensive. Owners often don’t realize how expensive they are when they first get one. That is because business owners tend to focus on the wrong number: the size of the weekly payment. Low recurring payments can create the illusion that you have an affordable loan.

Eventually, the costs can catch up with the business. This may lead them into financial problems. These financial problems are usually exacerbated by the fact that most companies use cash advances incorrectly. Companies use cash advances in situations that cannot be helped by a cash advance. The result: a bad situation gets worse.

When faced with high costs and escalating financial problems, some business owners opt to get a second cash advance. They hope the second advance will fill in the cash flow gap. Unfortunately, this is usually not the case.

How to make a bad situation worse

Getting the second advance is often a difficult decision. Even if you use the second business cash advance to pay off the first one. Refinancing an MCA with another one is very costly. The alternative of keeping both advances open is even costlier – and risky. Having more than one advance open at the same time is called “stacking.” Stacking merchant cash advances can lead to financial failure.

An expensive refinancing option

Let’s say that the business owner uses the new cash advance to refinance and pay off all their existing cash advances. This strategy leaves them with only one open cash advance, presumably with a lower payment. Isn’t this the better option? Yes, but marginally.

We have already explained in detail why you shouldn’t refinance an MCA with another one in a different article. We recommend you read the article, but here is a short summary.

Paying off a conventional (amortized) loan early usually offers savings. The size of the savings is usually proportional to how early you pay off the loan. This is because conventional business loans are amortized. They keep track of principal and interest separately. If you pay off the principal early, you don’t have to pay any “unearned interest.”

Cash advances work differently. They lump the principal and interest fee into a single combined total payment. Your company owes the total payment, even if you pay the advance off early. Thus, there is no advantage to paying off a cash advance early.

Consequently, by getting a new cash advance to pay off an existing one, you end up paying a lot of money. There are two reasons why this is the case. Some of the extra cost comes from borrowing the funds at full cost for a second time, from the new lender. The additional extra costs come from having to pay interest on a new loan to pay off all the interest of the old loan. Basically, you are paying “interest on interest.”

There is another cash advance refinance option in the marketplace. Some business owners are turning to so-called “merchant cash advance reverse consolidation cash advance loans.” Let’s examine those.

Should you use a MCA reverse consolidation loan?

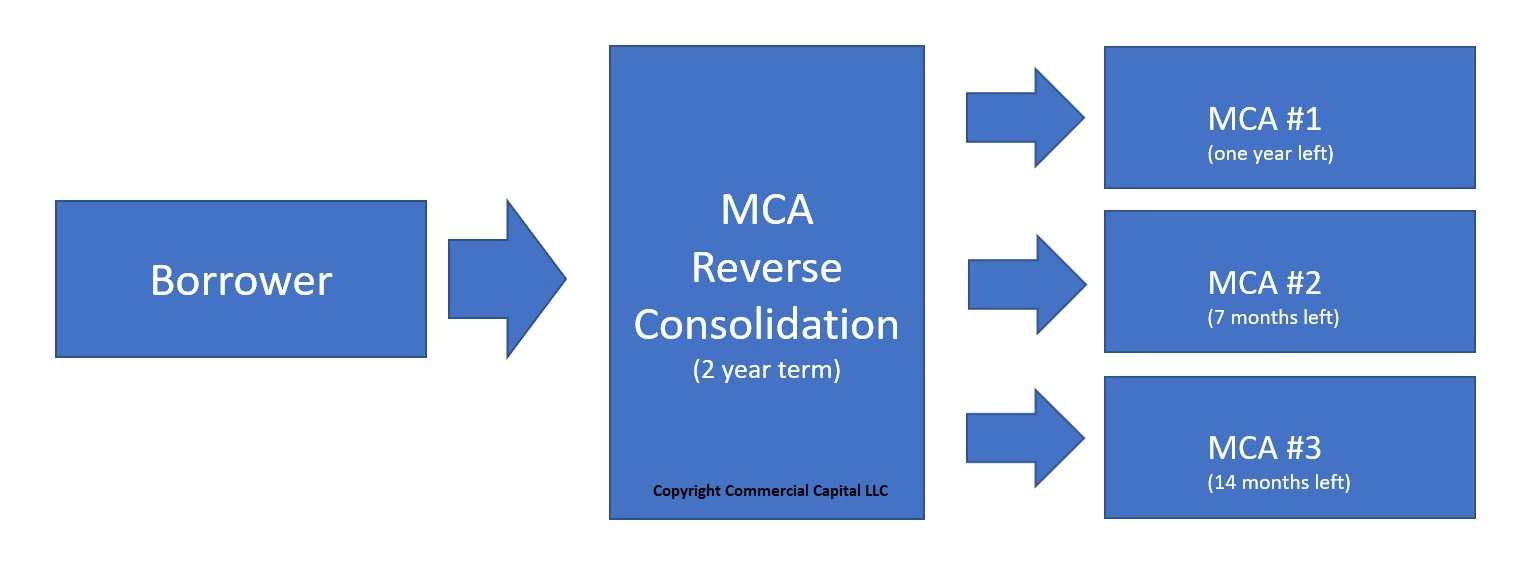

Merchant cash advance reverse consolidations have gained notoriety lately. These programs are designed for companies that have stacked multiple cash advances. These loans offer a new cash advance that is large enough to pay off all the outstanding advances.

The new advance has a long enough term that the recurring payment will be “low.” Thus, the weekly payment will appear manageable. On the surface, it looks just like what we discussed in the previous section: refinancing an existing MCA with a new one.

There is one important difference. The reverse consolidation company does not pay off the open cash advances, which would close them off. Instead, they take over your weekly payments. They make weekly payments to your lenders, while you make a single weekly payment to them. The following image shows a simplified version of how it works.

The weekly payment to the consolidation lender is usually lower than the combination of all your open payments. However, the loan itself is usually more expensive and for a longer term. You will still be making that consolidation payment well after all the other advances are paid off.

The dangers of MCA reverse consolidation

This solution is concerning for a couple of reasons. The first and more obvious concern is that it adds a new cash advance to your liabilities. This can make your stacking problem worse. This leads us to our second point.

Why does the consolidation lender keep your other loans open, instead of paying them off? As we showed previously, they have to pay the same total amount regardless.

The answer is simple. They only pay your weekly payments because it increases their rate of return and reduces their risk. This point is key. Their risk is reduced if you default on the consolidation loan.

Here is a hypothetical example. Let’s say that after getting a reverse consolidation loan, you encounter problems and are unable to pay the consolidation lender. One hopes that this situation never happens, but it is possible.

Initially, you will probably have to pay some penalties. That is common. But if the situation continues, you have to ask yourself: will the consolidation lender keep paying your other lenders?

Let’s take it one step further. If the consolidation lender were to hypothetically stop paying the other lenders, what will these lenders do? In all likelihood, they would also charge you penalties. If the situation continues, they would declare a default. Before long, your company could have essentially defaulted with all of its lenders.

If you decide to get a cash advance reverse consolidation, consider working with your CPA first. Examine all the costs and benefits and create a business case. Ensure that the numbers work for your business. Lastly, ensure you understand what happens to your other lenders if you default on the consolidation loan.

The best ways to get out of a cash advance

However, business owners still have options. Let’s start with the following premise. The best way to get out of unmanageable cash advance debt is to refinance it with an affordable product. It’s that simple. With this premise in mind, most small business owners have two options. They can use conventional small business loans or they can use asset-based loans. Both solutions have their advantages and disadvantages.

1. Business loans

The most cost-effective option to refinance a cash advance is a conventional amortized business loan. Conventional loans have competitive market rates, far below those of merchant cash advances. Additionally, loan terms can also be adjusted to structure an adequate solution for your company. Therefore, business loans can be an ideal tool to refinance or consolidate business debt.

Most small business loans are backed by the Small Business Administration (SBA). The SBA backs these loans to make them accessible to small business owners. This backing helps owners who have less-than-perfect situations.

SBA-backed loans have the perception of being difficult to get. This is because of their paperwork and asset requirements. In reality, SBA-backed loans have similar requirements to that of conventional bank loans.

However, SBA-backed loans do have more detailed documentation requirements than a cash advance. It’s expected. Lenders require more information to properly understand your business. This information allows them to know who they are lending to – which lowers their risk and enables them to offer market prices.

2. Asset-based loans

Asset-based loans (ABLs) allow you to capitalize on assets such as receivables, inventory, machinery, and business-owned real estate. ABLs have a higher cost than business loans but are easier to get, and are more flexible. Although more expensive than conventional loans, ABLs are still reasonably priced.

The financial structure of an ABL varies based on the type of asset that is being financed. For example, receivables are financed using a revolving credit line structure. Assets such as machinery and business real estate, on the other hand, are financed using an amortized term-loan structure.

An ABL allows you to leverage your assets and use the proceeds to pay off expensive cash advances. When executed correctly, the ABL can be structured to provide a sustainable path forward.

Need to refinance business debt?

For information about our business debt refinancing and consolidation program, please don’t call the number above. Instead, fill out this form – a specialized agent will contact you.