Due to the dynamics of the healthcare industry, hospitals can encounter cash flow problems from time to time. Hospitals are under pressure to reduce costs and work with insurance companies that pay slowly. This delay affects their revenues and cash flow. On the other hand, hospitals face constant pressure to meet their financial obligations. They have numerous expenses – such […]

Blog

How an Asset-Based Loan Can Finance a Trucking Company

It’s not unusual for new or growing trucking carriers to have cash flow problems at one point or another. Cash flow issues commonly affect companies that are growing quickly. Before long, the carrier starts running low on funds and cannot pay some of its corporate expenses. At best, this situation makes managing the company difficult. […]

How to Finance an Auto Repair Shop

Auto repair and body shops with commercial accounts sometimes get into cash flow problems due to slow-paying invoices. These problems can usually be solved by changing business practices or by using financing. However, getting financing for an auto repair shop can be very difficult. This article discusses five ways to improve cash flow and finance […]

Executing Your Trucking Company Business Plan (6 Steps)

The most challenging step in starting a trucking company is often the first step – getting started. However, this step can be difficult for many first-time trucking entrepreneurs. Everyone knows that the best business plan is useless unless you put it into action and implement it. This article helps you take on the six most […]

Factoring for Staffing Companies (Payroll Financing)

Running a temporary staffing company can be very profitable. The current business environment favors outsourcing employees rather than hiring them. This situation creates an attractive opportunity for staffing agencies. However, running a successful staffing agency is challenging. One of their biggest challenges is making payroll on time. This problem affects small and growing staffing companies. […]

Using Invoice Factoring to Finance Startups

Summary: Finding the right source of financing for a startup is one of the most challenging tasks for founders. Guided by what they see in the popular media, founders often think that the best way to finance a company is with venture financing, angel financing, or a business loan. This is not the case. Few […]

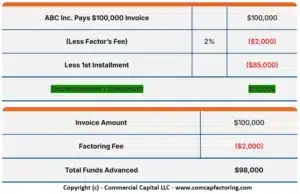

Invoice Factoring Examples (With Complete Details)

Summary: This article offers two examples of how invoice factoring transactions work. It helps you understand how the account is funded, how fees are charged, and how the transaction is settled. The article covers the following subjects: 1. What is invoice factoring? Factoring is a tool that helps companies that have cash flow problems due […]

Is Invoice Factoring Better Than a Business Cash Advance?

In recent years, a type of Merchant Cash Advance known as a Business Cash Advance has been gaining popularity as a way to finance small businesses. Often, companies compare business cash advances against other products, such as factoring and purchase order financing, to determine which offers the best solution to their problems. This article compares […]

Selling Accounts Receivable to Obtain Short-Term Funds

Summary: Companies experience short-term cash flow problems every so often. It is a common business problem that can happen due to sudden growth, large clients paying slowly, or other reasons. The typical approach to solving this problem is to get a loan. However, loans and lines of credit aren’t always the best solution. Qualifying for […]

Selling Accounts Receivable to Finance Your Business

Companies experience cash flow problems at one point or another. These issues are common in small companies and in companies that are growing quickly. Cash flow problems can usually be fixed using the correct type of financing. However, getting a bank loan or a line of credit remains out of reach for many small and […]