Summary: Trucking load boards remain popular with carriers looking to get freight loads. Load boards offer a simple solution for shippers who need freight moved and for carriers with available capacity. Many new owner-operators hope to rely solely on load boards to grow their business. Perhaps this strategy sounds easy because you can find loads […]

Blog

Seven Benefits of Factoring Fuel Advances

Running a truck or a small fleet is very expensive. The cost of fuel, which must be bought effectively, is one of the biggest expenses for fleet owners. Keeping your units fueled up can be difficult. Many shippers and brokers don’t offer quick pays. Instead, they pay their invoices in 30 to 60 days. Most […]

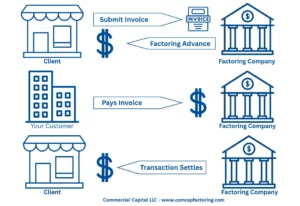

How Does Factoring Work?

Summary: Factoring is a type of financing that helps improve the cash flow of companies that have slow-paying invoices. This form of financing gives the client access to immediate funds, which can then be used to pay for business expenses and to grow. In this article, we show you how factoring works. We go over […]

Doctor Loans vs. Medical Factoring

One of the advantages of being a medical doctor is that you usually have financial options. If your medical practice runs into cash flow problems, you can choose from a number of solutions such as medical factoring, doctor loans, conventional loans, or an SBA loan. The option you choose depends on the type of problem, […]

The Truth About Cheap Invoice Factoring

Summary: Finding a company that offers good factoring rates can be difficult. Several companies advertise seemingly cheap factoring rates. However, these rates often look “too good to be true.” In many cases, these factoring plans appear cheap but become very expensive once you read the fine print. Finance companies are in a very competitive environment. […]

Will Using Fuel Advances Help My Small Trucking Fleet?

Summary: Fuel advances have been gaining popularity among owner-operators and small fleet owners in recent years. They can be a useful resource for carriers that are just starting out or growing quickly. However, fuel advances also have drawbacks and can be an expensive solution. Carriers should use them carefully. This article explains how fuel advances […]

How Does Fuel Advance Factoring Work?

Summary: A fuel advance is an add-on that many factoring companies offer alongside their freight bill factoring programs. Fuel advances provide funds to cover fuel and other expenses. Your company gets access to these funds when you pick up a load. Fuel advances are used by small and growing trucking companies that need funds to […]

How Do Factoring Companies Buy Accounts Receivable?

One of the advantages of invoice factoring is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the factoring company in exchange for an immediate payment. This article describes how a company sells their invoices to a factor and covers the following information: 1. Factoring basics Invoice factoring […]

How To Finance a Timber/Lumber Export Company

There is a large market opportunity for US and Canadian companies that export timber, usually as logs, to Europe and Asia. Although timber is a commodity, some types of wood – especially high-demand specialty hardwoods – can command high profit margins. The combination of high demand and decent profit margins makes these transactions very appealing. However, […]

How to Choose the Best PO Financing Company

The market is full of companies that advertise purchase order (PO) financing programs. However, only a few companies have the experience, knowledge, and capital to handle these transactions successfully. Choosing the right finance company is important because it plays a critical role in the outcome of your transaction. In this article, we discuss: 1. What […]