Summary: Middle-market companies that are out of compliance with their lenders are typically assigned to the Special Assets group. Usually, these companies must find a new lender as part of their workout process. Few lenders finance distressed companies in this market segment. Consequently, finding a replacement lender can be a significant challenge for lower middle-market […]

Blog

How Does a Borrowing Base Certificate Work?

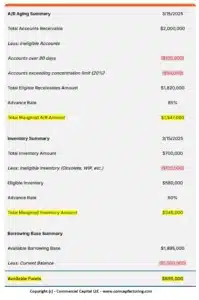

A borrowing base certificate is a document that a company uses to draw funds from its asset-based loan (ABL). The certificate is typically used in ABLs secured by accounts receivable since these loans are structured as revolving lines. This article explains how borrowing certificates work and covers the following: 1. What is a borrowing certificate? […]

Asset-Based Loan Qualification Requirements

Summary: Asset-based loans are commonly used by small and middle-market companies that need financing. Their main advantage is that they offer a flexible structure and support several types of collateral. Asset-based loans are popular with companies because these loans have fewer covenants and simpler qualification requirements than bank financing. Read “What is an Asset-Based Loan? […]

What is Special Assets? What Should You Expect?

Summary: The Special Assets department handles loans that are out of compliance and in trouble. Lenders assign loans to this department to mitigate potential losses. This change marks a turning point in your relationship with the lender, as they likely want to exit the lending relationship. A company can improve its chances of success in […]

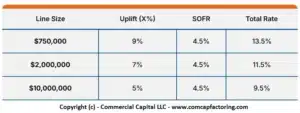

Asset-Based Loans – Costs and Rates Explained

Asset-based loans (ABLs) are a type of financing that enables companies to get funding based on their assets. These loans are popular among small and midsize businesses because they offer simpler qualification and compliance requirements. While asset-based loans are more expensive than conventional bank financing, they are cheaper than most other solutions. This article discusses […]

What is a Ledgered Line of Credit? How Does it Work?

Summary: A ledgered line of credit is a type of asset-based financing that enables companies to draw up to 85% of their Accounts Receivable (A/R). Ledgered lines are more flexible, easier to use, and simpler to manage than comparable solutions. This article explains how ledgered lines work, their advantages, qualification requirements, and how they compare […]

Factoring for Auto Transport Companies and Car Haulers

Summary: Auto haulers frequently have trouble finding a factoring company that can work with them. Unfortunately, many factoring companies cannot finance auto haulers due to the risk of cargo damage, claims, and other issues. This article explains how freight factoring works, why auto transport companies are challenging to finance, and how to find a factoring […]

Trucking Insurance Basics for Owner Operators and Small Fleets

Starting a company as an Independent owner-operator can be difficult. The industry has a number of complex requirements that owners need to comply with at all times. One of the more confusing and expensive issues they deal with is insurance. This article provides a simple explanation of the industry and its products. It prepares you […]

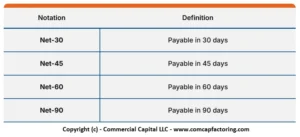

How to Offer Net-30 Terms Effectively

Summary: Waiting 30, 45, or even 60 days to get an invoice paid is a challenge for many business owners. Small companies often have to wait for payment because their commercial sales are made on credit. This type of trade credit is commonly known as “payment terms.” Companies must offer payment terms because their clients […]

Factoring Cost vs. Rates (They are Different)

Summary: To a large extent, business owners think that factoring rates, factoring fees, and the factoring cost of a dollar are all the same. Although they are related, there are important differences. Actually, low factoring rates may translate to lower fees, but may not necessarily translate to lower costs per advanced dollar. This article helps […]