Merchant cash advances have become a very popular form of financing among business owners. They are easy to get and set up. Their apparent convenience attracts companies that don’t want to go through the conventional lending process. There is one catch The speed and convenience of cash advances come at a steep price. These loans […]

Blog

Why You Shouldn’t Refinance an MCA with a Cash Advance

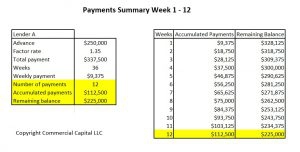

Merchant cash advances are a popular but very expensive form of business financing. Companies that have excessive cash advance debt often look to refinance (or consolidate) these loans to escape from their high weekly cost. In this article, we take you through a merchant cash advance refinancing transaction and discuss why merchant cash advances are […]

Should You Refinance Your Merchant Cash Advance? How?

Companies that struggle with their merchant cash advance (MCA) debt often consider using debt refinancing. They anticipate that this option will solve their financial problems. However, the decision to refinance debt isn’t easy. Using the wrong product to refinance your debt can leave you worse off. If done incorrectly, it could lead to the failure […]

How to Get a Small Business Debt Consolidation Loan

In this article, we discuss the steps you need to take to get a debt consolidation loan for your company. While the actual steps vary by lender, most lenders follow this process. We also discuss the documents that lenders request from you. This information will help you be better prepared for the application process and […]

Requirements for Business Debt Consolidation / Refinancing

In this article, we discuss the requirements for a business debt consolidation and refinancing loan. Qualification requirements vary by lender. However, most lenders in this market have similar requirements. In our case, we work specifically with small companies that have: At least $500,000 in debt A minimum history of 3 years in business Equipment and/or […]

How to Refinance Expensive Business Debt

Getting a loan with good terms can be difficult for small business owners. New business owners are especially affected by this problem. Consequently, many small companies have to make do with ‘less-than-perfect‘ financing. They get loans that aren’t well suited for the company and can be very expensive. Expensive loans become a drag on your […]

How Does Business Debt Consolidation Work?

Companies can encounter financial trouble if they have too much debt. All too often, they also have too much of the wrong kind of debt. This situation is financially unsustainable. Debt payments take a substantial portion of revenues. Therefore, the business cannot keep up with payroll, supplier payments, and other important expenses. Ultimately, the situation […]

Pros and Cons of Invoice Factoring

Factoring invoices has been gaining popularity as a way to finance companies that have cash flow problems due to slow-paying commercial clients. Factoring works by providing an advance on these invoices. This advance provides cash flow to operate the business and grow. To learn more details about factoring, read “What is invoice factoring?” You can […]

Government Contract Receivables Factoring

Summary: Getting a contract from the U.S. federal government has several advantages for small business owners. The government can provide your company with a steady flow of work if you know how to find it and bid for it. It can be an excellent source for projects that help you take your business to its […]

Supplier Financing for Companies that Sell to Retailers

Getting a contract from a large retailer can be very exciting for any business owner. It can certainly be a defining moment in your career – if you are prepared for it. But large contracts can also be a double-edged sword that can hurt a business that is not well prepared. They can tie up […]