Non-recourse invoice factoring plans have quickly become very popular with companies that are looking for a factoring plan. The main advantage of non-recourse plans is that the factoring company absorbs the loss of advance, if your customer does not pay due to a credit reason. Factoring companies use different rules to define what is a qualifying ‘credit reason’. […]

Blog

How Much Does Factoring Cost?

This article explains how to calculate the factoring fees of a factoring proposal. It covers the three most common proposal fee types: flat-rate, variable-rate, and discount-plus-margin. We cover the following: 1. How does factoring work? This article assumes that you are already familiar with factoring and know how it works. Here is a short summary […]

How to Evaluate Factoring Companies

The decision to use factoring to improve the cash flow of your company is not easy and should be done carefully. The success of your business depends on making the right choice and partnering with the right company. In this article, we discuss how to evaluate factoring companies effectively. The process is simple to use […]

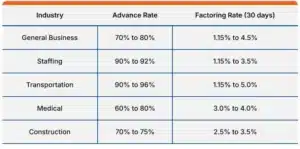

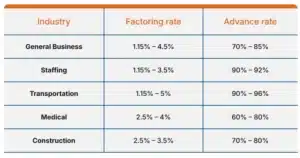

Typical Factoring Rates

In this article, we discuss factoring rates and how to use rates to determine the total cost of using this solution. From this article, you will learn: If you are not familiar with factoring, consider reading “How does factoring work?” before reading this article. If you just want an instant rate quote, try this form. […]

Do You Qualify For Invoice Factoring?

Factoring plans can provide many of the benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing. Most factoring companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice factoring. Note: To learn more about factoring, read […]

Invoice Factoring with No Minimums

Factoring plans often include minimum financing requirements. Committing to a minimum funding volume can help you get better factoring rates. However, it can also hurt your company if your minimums are not managed correctly. Most small and growing companies should consider factoring plans with no minimums, at least initially. From this article, you will learn: […]

What is a Line of Credit Secured by Accounts Receivable?

Summary: A line of credit secured by Accounts Receivable (A/R) is a type of financing that uses your invoices as collateral. It provides a revolving line that allows companies to draw up to 85% of their A/R. Several products can provide a line secured by invoices. Your product choice is determined by your company’s size, […]

Do You Need Collateral for a Line of Credit?

Getting a business line of credit can be a challenge for small business owners. Most lines are difficult to qualify for and have hefty collateral requirements. For many business owners, this challenge represents an obstacle that a few businesses can overcome. From this article you will learn: Why all lines of credit need collateral The truth about […]

What is Invoice Financing? How Does it Work?

Invoice financing is a general term that applies to several products that allow you to finance accounts receivable. The two most-used solutions are factoring and sales ledger financing. In this article, we discuss both solutions in detail. The article covers: 1. Quick Summary Factoring allows your company to sell its invoices to improve your cash […]

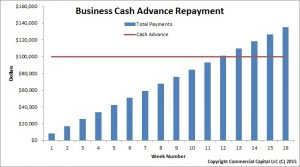

How Does a Business Cash Advance Loan Work?

Merchant cash advances (MCAs) have been gaining popularity in recent years. The product started as a solution to finance future credit card sales. However, this product has evolved into a solution that allows companies to finance future sales of almost any kind. The term business cash advance is probably a better description. From this article you will learn: […]