One of the bigger mistakes that prospects make when negotiating a factoring agreement is focusing their discussions on the rate alone, rather than focusing on the total cost of the service. While it’s true that the rate can sometimes be a good measure of total cost in many financing transactions, that is not the case for an invoice financing transaction. Making this mistake when negotiating with a finance company can be very costly to you.

It’s easy to see why prospects become confused on this subject. With most business loans or lines of credit, the finance rate applies to the amount that you borrow. So, obviously, the rate and total cost are the same (or very similar). Invoice factoring transactions, however, are structured differently. When you finance an invoice, the factor does not advance the entire amount immediately. Rather, they break the transaction into two installments:

- You get the first installment, between 70% and 85% of the receivable, as soon as you invoice a client.

- You get the remaining funds once your client pays.

However, the fee is usually determined on the total value of the invoice and not just on the advance. This distinction is very important.

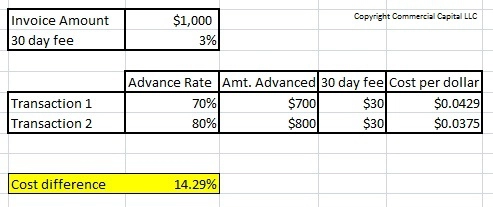

Because of this difference, the advance is an important part of your total costs of funds. This concept is easier to understand if you look at two transactions where everything is the same, except the advance. For the sake of simplicity, let’s assume that you want to factor a $1,000 invoice for 30 days. The rate is 3% for every 30 days. In this chart, Transaction 1 has an advance of 70% and Transaction 2 has an advance of 80%.

Now, let’s look at the cost per dollar advanced in each transaction:

We calculated the cost per dollar by dividing the 30-day fee over the amount advanced: $30/$700 = $0.0429. Don’t be deceived by the fact that the cost is expressed in pennies. If you look at the difference as a percentage, you will realize that you are paying 14.29% more if you factor with the lower advance (Transaction 1). That is a big difference.

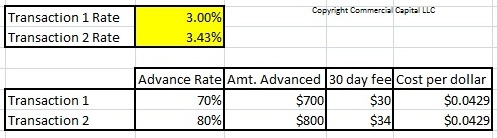

To help emphasize this point, let’s look at this transaction from a different perspective. What rate would make Transaction 2 have the same cost as Transaction 1? We plugged in the numbers and came up with a second chart. As you can see, you would need to pay a rate of 3.43% for 30 days to have the same total cost. Since the rate goes up, the 30 day fee would be higher as well.

If there is one thing you should take from this article, it is that you should not focus your negotiation on rates alone; rather, you should negotiate on total cost.

Obviously, this article oversimplifies some things because many companies structure their proposals differently. Some have fees that are all-inclusive, while other companies have a number of ancillary fees, or they charge for their services differently. However, our point does not change: you must negotiate for a lower total cost.

You can use this method to compare competing proposals.

Looking for a factoring quote?

We can provide factoring lines with high advances at low rates. For more information, get an online factoring quote or call (877) 300 3258.

Disclaimer: This article is for information purposes only and is not intended as financial or legal advice. Please get competent advice if you need it. Also, the accuracy of the calculations is not guaranteed.