Purchase order financing helps small companies with the supplier costs associated with a large order. It enables small business owners to fulfill large orders and book the revenue. This article discusses how purchase order finance companies pay your supplier expenses. We cover: For more information, read “What is Purchase Order Financing? How Does it Work?“ […]

Purchase Order Financing

Guaranteed Sales And Purchase Order Financing

It’s not uncommon for us to speak to a prospect who is very excited about a large purchase order they just received from a very reputable company. Furthermore, as we review the details of the order, we believe that the order will be a good candidate for purchase order financing because it meets these three […]

Purchase Order Financing Qualification Requirements

Purchase order (PO) financing has been gaining popularity as a tool to fund large purchase orders. However, many prospective clients often misunderstand what is needed to qualify for this solution. Clients often believe that they only need a substantial purchase order to qualify. Unfortunately, this assumption is wrong. Transactions often have a lot of moving […]

How Loans Against Purchase Orders Work

Getting a large purchase order can be a great opportunity if the company has the funds to fulfill it. Unfortunately, small companies often miss these opportunities because they lack the funds to execute the transaction. In this article, we discuss a way to finance purchase orders. We cover the following: 1. How are purchase orders […]

Small Business Purchase Order Financing

One of the greatest challenges for small product wholesalers is getting an order too large for them to fulfill. Large orders are good only if you have the financial resources to fulfill them. If you can’t fulfill them, you risk losing the order – and the customer – to a competitor. Being unable to handle […]

How do Purchase Order Financing Companies Prepay Foreign Suppliers? (Letter of Credit)

Most of our purchase order (PO) financing clients are importers who buy goods from another country and sell them to companies in the US or Canada. Some of these importers usually request that we prepay their supplier by wire transfer. While purchase order financing companies can pay foreign suppliers with a letter of credit, documentary collection, […]

Inventory Financing vs. Purchase Order Financing

Both purchase order (PO) financing and inventory financing can be used to finance certain types inventory. However, both solutions work very differently and serve very different business objectives. From this article you will learn: 1. What is purchase order financing? Purchase order financing allows you to finance the supplier costs associated with a specific customer purchase order. […]

Why Do Purchase Order Finance Transactions Need Inspections?

Purchase order finance companies typically require that the goods they are financing be inspected by an independent company prior to shipment. The inspection company verifies that the quality, quantity, shipment date, and other parameters meet the specifications of the purchase order. The inspection clause is usually written into the language of the letter of credit […]

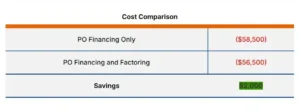

Should You Use Factoring with Purchase Order Financing?

Summary: Purchase order (PO) financing companies often advise prospective clients to work jointly with a factoring company. Combining both products can reduce the total financing cost of a transaction and provide additional capital to the company. However, settling a transaction through a factoring line only benefits some transactions. This article explains how a purchase order […]

Financing Your Import Business with Purchase Order Financing

Managing the cash flow of an import company can be challenging for a small or mid-sized company. While import companies can be profitable and have high gross margins, they require a substantial cash reserve to operate. And you need an even bigger cash reserve if your company is growing or taking larger orders. You need this […]